The fake PhonePe Payment tricks are on a horrendous rise these days. The number of fake payment apps available online and the YouTube tutorials on them is almost scary. PhonePe is one popular transaction/ payment app that has had the greatest hits from scammers who use fake apps to generate payment images or screenshots that look just like the original one. How do you stay cautious of such fraudulent people and activities? We are going to discuss all that now so that you stay safe from such scams.

Also Read: Google Wallet Vs Google Pay: Difference, Uses, Features Explained!

What Is Fake PhonePe Payment?

Before we start, let’s first understand the process and what really happens in fake PhonePe Payments or what exactly we mean by it.

This is how the app works- whenever a payment is made through the PhonePe app, the sender requires either a QR code generated from the receiver’s app, a phone number, or a UPI ID. Once the money is sent, the sender and receiver both get a confirmation of the transaction. The sender can show that confirmation to the receiver to inform them that they have paid the money.

This is where scammers create counterfeit versions of this confirmation page to trick individuals and businesses into thinking they have received legitimate payments when, in reality, no money has been transferred.

These Are Some Common Scamming Methods

| Scam Type | Brief Description |

|---|---|

| Misleading Local Shops | Fake payment screenshots used to get goods without paying |

| Online Businesses | Fake payment proof sent to receive products |

| Sending Cash Trick | Victims send cash for a fake online transfer |

| Persistent Money Requests | Pressure to return money from a fake transfer |

Identifying Fake PhonePe Payment Confirmation

The first and most important step is to identify the moment someone is trying to scam you. There are some tell-tale signs that add to the suspicion rightfully. Some of them are listed below:

Unverified Payment Confirmations:

A missing transaction detail in your PhonePe app or confirmation from the Bank can be a good way to tell if the payment was genuine. Always cross-verify from these official sources.

Lack of Official Notifications:

Genuine payment confirmations will come through official channels like SMS, email, or in-app notifications.

- For SMS: Notice whether the number from which you are receiving the SMS is official or not. You can check the past SMSs from the number.

- For Emails: Be extra careful when reading the email address from where you may have received the mail. Go to the official website to cross-verify the email address if needed.

These are simple ways to identify a fake PhonePe Payment.

Random Contacts Asking For PhonePe Details

You have never come across this contact before and never heard them. However, out of the blue, they claim to be from PhonePe and are asking for sensitive information. Now that’s a red flag! As the PhonePe executives themselves admit that they will never request these details, you can probably refuse to engage.

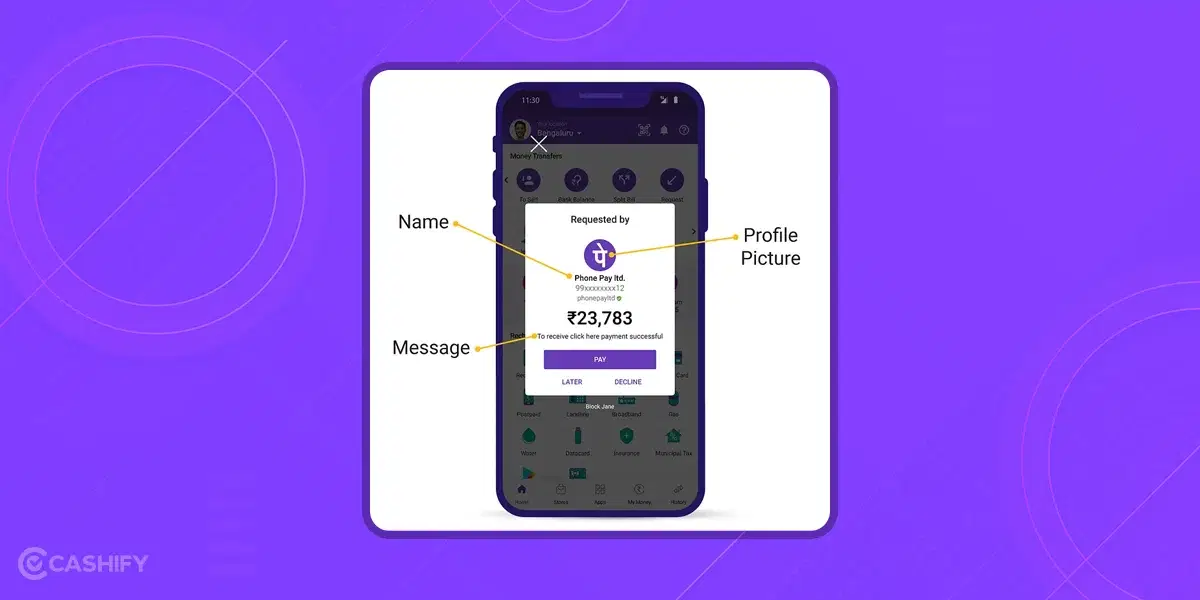

Suspicious Sender Details

When you receive a payment request, verify the sender’s details, such as name and UPI ID. It should match the original design, font, and style as it happens when you make a genuine payment. Also, fake requests often come from unknown parties.

Also Read: How To Split Bill With Group on Google Pay

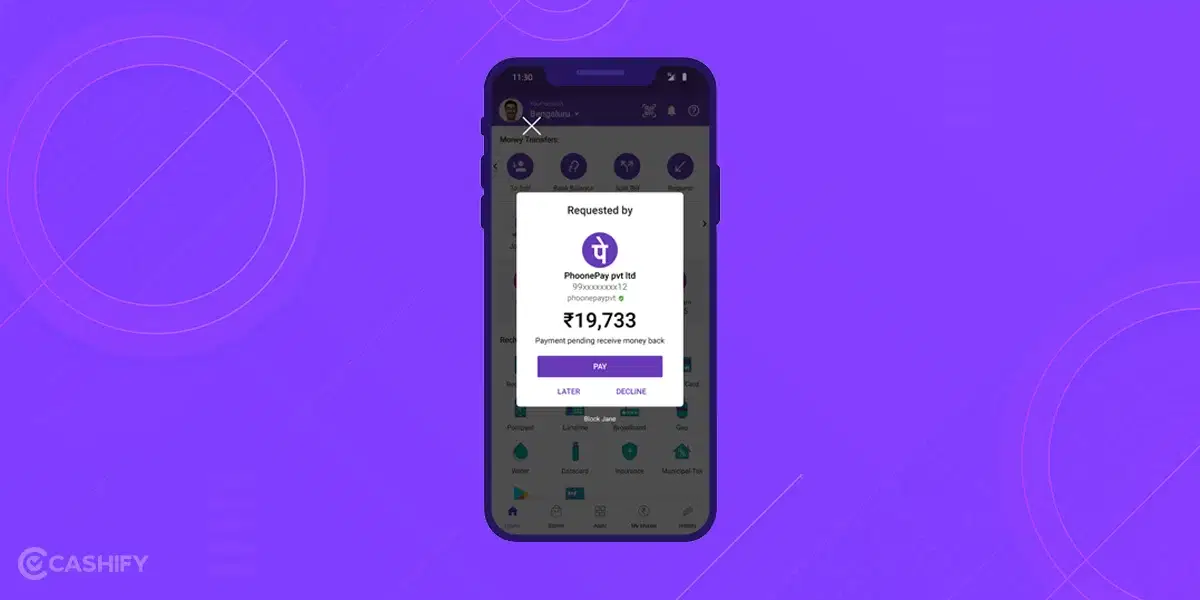

Request Money Fraud: New Fraud!

This scam trick is gaining momentum on the PhonePe app these days, and lots of users have fallen prey to it. Request Money fraud comes along with the ‘request money’ feature on the PhonePe App. Basically, with this feature, one can request payment of a certain amount (filled by them) to another person, known as a ‘collect-call’ request. With this action, a pop-up appears on the PhonePe app of the one who receives the payment request, along with the options to ‘Pay’ or ‘Decline’ it.

Here is how Scammers take advantage of this feature:

- Scammers are often found on websites like OLX or Quikr posing as buyers.

- They send collect payment requests instead of paying money.

- They send fake messages like “Once you pay, you will receive money.”

- Sometimes they pretend to be from companies like Flipkart or Myntra.

- They claim you have won a prize and send messages like “Congratulations!”

- They send collect payment requests using fake company logos.

- Fraudsters also share fake helpline numbers on Twitter.

- They pretend to help with money transfer or cashback issues but steal money instead.

A simple takeaway to safeguard yourself from fake PhonePe Payment is to understand that you do not need to click ‘Pay’ or enter your UPI PIN to receive money.

Already Fallen For Fake PhonePe Payment Trap? Here’s What You Should Do:

Don’t be upset, it wasn’t just your lucky day. However, don’t lose hope, you can take some important steps if such an incident happens:

| Method | How to Report |

|---|---|

| PhonePe App | Go to Help > Have an issue with the transaction or Account security issue / Report fraudulent activity |

| PhonePe Customer Care Call | Call 080-68727374 or 022-68727374 to speak to an executive and raise a ticket |

| Web Form | Fill out the complaint form on support.phonepe.com |

| Twitter (X) | Tweet your issue and tag @PhonePeSupport; they will DM for details |

| Police / Cyber Crime Cell | Lodge FIR at nearest police station or report online at cybercrime.gov.in or call 1930 |

| Report fraud via Facebook Official PhonePe page | |

| Grievance (Existing Complaint) | Log in to grievance.phonepe.com and submit your ticket ID |

Best Tips To Avoid Fraudulent Transactions

- Always double-check payments and do not trust screenshots, as they can be easily edited using fake PhonePe apps.

- Only believe payment confirmation messages from your bank or the PhonePe app.

- Never share personal details like card number, expiry date, PIN, or OTP with anyone.

- PhonePe representatives will never ask for your PIN or OTP.

- If someone claims to be from PhonePe, ask them to send an email from an official @phonepe.com email ID.

- Never download screen-sharing apps like AnyDesk, TeamViewer, or Screenshare to verify payments.

- These apps can give scammers control of your phone.

- Contact PhonePe only through their official app, website, or verified social media accounts.

Also Read: How To Change Or Reset UPI Pin on Google Pay?

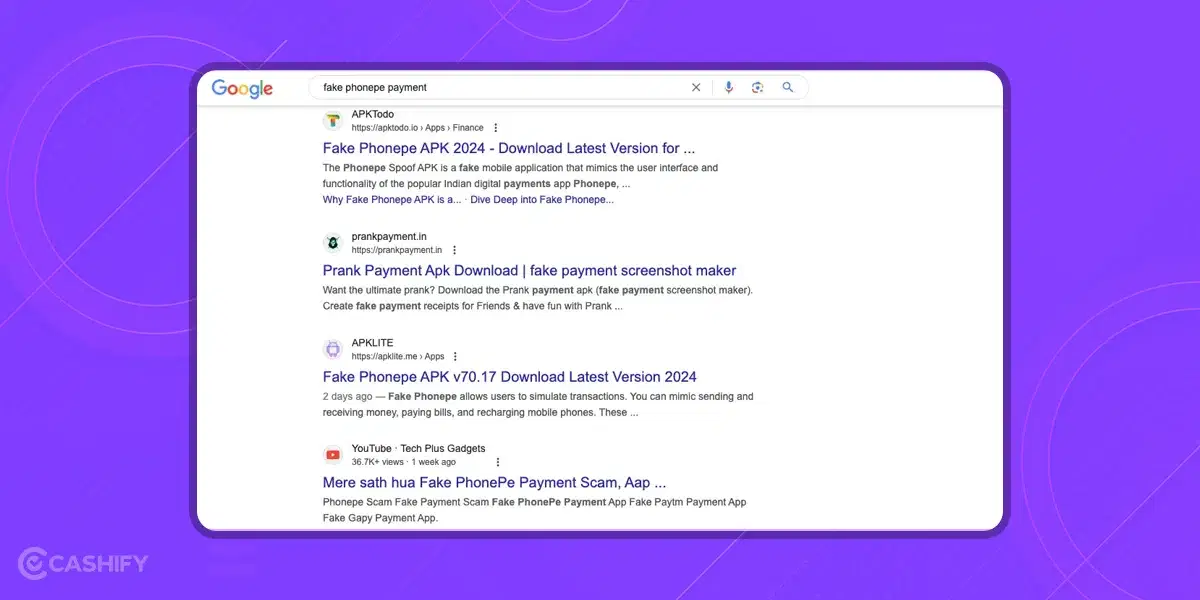

Common Fake Apps to Avoid

Scammers love fake apps that make phony PhonePe screenshots. These apps promise “proof generators” but steal your personal data. Popular fake apps include “UPI Fake Pay” or “Payment Screenshot Maker” on shady sites or YouTube. They let anyone edit amounts, dates, or even bank names in seconds.

Never download them! They look real but have blurry edges or wrong colors. For example, a fake shows “Rs. 3000 paid” with a shaky green tick. Real PhonePe has crisp fonts and bank logos.

Here is how you can do a quick check. Open the Play Store and search “fake PhonePe.” If you see download links, report them. Delete any suspicious apps now. Stick to official PhonePe only. If you’re a shop owner, warn your staff too.

Real vs Fake Screenshot Guide

Screenshots fool fast. Here’s a simple table to spot fakes in 10 seconds

| Check This | Real PhonePe Proof | Fake Warning Signs |

| Time & Date | Matches your app exactly | Wrong hour or blurry text |

| Amount Color | Bold green, fixed size | Easy to change, thin font |

| UPI ID/Name | Full like @okaxis, verified tick | Cut off or fake spelling |

| Extra Alerts | Comes with bank SMS | Screenshot only, no SMS |

Zoom in on edges. fake screenshot pixelate. You can even ask for a live app demo.

In The End

The key takeaway is to be careful whenever you engage in online money transactions, especially through PhonePe or other similar payment apps. Learn to identify fake PhonePe payment and avoid sharing anything other than your PhonePe number as that’s all one needs to send you money through this app.

Also, don’t forget to share this blog with your peers and family who frequently use PhonePe payment.

Frequently Asked Questions

What are common PhonePe scams in 2026?

In 2026, scammers use fake apps, edited screenshots, and messages that look very real. They trick people by showing fake “payment successful” screens or sending fake payment requests.

How can I know if a PhonePe payment is real?

A real payment will always show in your PhonePe app and you will also get a message from your bank. Screenshots or WhatsApp messages are not proof of payment.

What should I do if I see a fake payment?

You should report it quickly. Go to the PhonePe app > Help > Report an issue. You can also call customer care or report it to the cyber crime helpline 1930.

Can fake apps show payment success?

Yes. In 2026, scammers use fake PhonePe apps that show “payment successful” messages even when no money is sent. Always check your official PhonePe app.

Do I need to enter PIN to receive money?

No. You never need to enter your PIN to receive money. If someone asks for a PIN, it means you are sending money.

Do real PhonePe staff ask for OTP or PIN?

No. PhonePe staff never ask for OTP, PIN, or card details. Anyone asking for these details is a scammer.

Are screen-sharing apps dangerous?

Yes. Apps like AnyDesk or TeamViewer can give scammers control of your phone. Never install them for payment help.

How should I contact PhonePe safely?

Contact PhonePe only through the official app, website, or verified social media pages. Do not trust phone numbers shared by strangers.

How can shopkeepers stay safe?

Shopkeepers should not accept screenshots. They should wait for payment confirmation in the PhonePe app before giving goods.

How can I protect my family from scams?

Tell them not to share PINs or OTPs, not to trust screenshots, and to report fraud quickly. Awareness helps everyone stay safe.

If you’ve just bought a new phone and don’t know what to do with your old phone, then here’s your answer. Sell old mobile to Cashify and get the best price for it. If you are planning to buy a new phone, check out Cashify’s refurbished mobile phones. You can get your favourite phone at almost half price with six-month warranty, 15 days refund and free delivery.