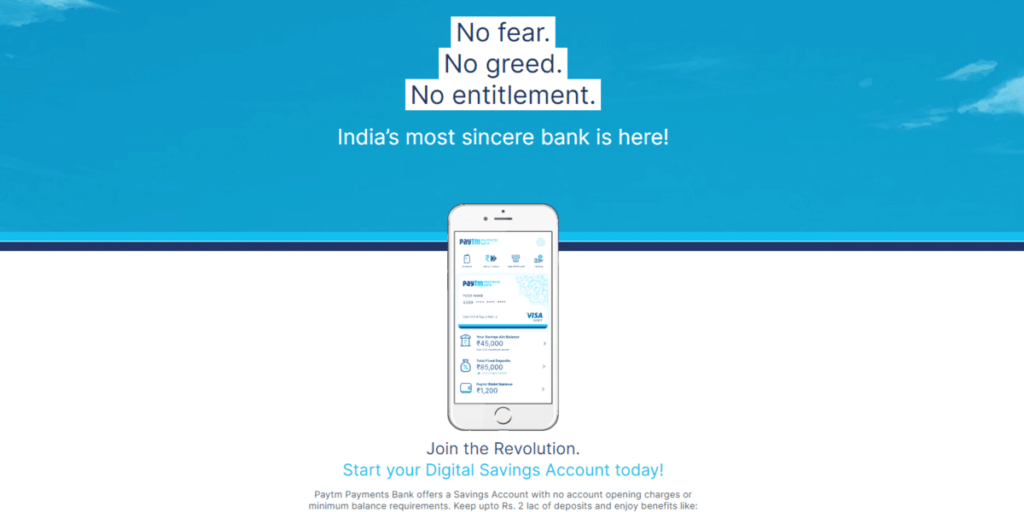

RBI (Reserve Bank Of India) has taken action against Paytm Payment Bank for taking new deposits and credit transactions from February 29. It has also directed it to stop taking new customers with immediate effect.

Also Read: 7 Instant Paytm Cash Earning App You Should Know About

However, this action does not affect the normal Paytm app users. Here is everything you need to know about this action and how it will affect your usage of Paytm.

RBI Takes Action Against PayTM Payment Bank, Services To Be Affected From February 29

In a press release, RBI has announced that it is taking action against Paytm Payment Bank under section 35A of the Banking Regulation Act,1949. Furthermore, the central bank has declared the bank will no longer be able to perform the following functions from February 29:

- Take new deposits, credit transactions, top-ups in any customer account, prepaid instrument, wallet, FASTags, wallets, and NCMC cards from February 29.

- Moreover, the bank will provide no banking services such as AEPS, IMPS, BBPOU or UPI.

- The Nodal accounts of One97 Communications and Paytm Services Ltd will be terminated by February 29

Also Read: Make Google Pay, PhonePe, PayTm UPI Payments Without Internet: Step-By-Step Guide

However, customers can withdraw their balance or utilize it without any restrictions. These curbs only affect Paytm Payment bank users, not the regular Paytm app, so you can continue using it.

Paytm Issues Statements On RBI Actions

Paytm Payment Bank customers can use the money in their wallets, and there are no restrictions on its withdrawal. The company has also released a statement saying it will take immediate steps to comply with the RBI directions and work with it to address its concerns.

Also Read: What Is UPI Lite? Key Features, Advantages, And Everything You Need To Know

Moreover, the statement reiterates that customers can use deposits in savings accounts, wallets, FASTags, and NCMC accounts. The merchant payment network, which includes the Paytm QR code, Paytm soundbox, and Paytm card machine, will continue to work as usual.

Paytm will also pursue partnerships with other banks to continue offering its service to customers. In addition, financial services such as loan distribution, insurance distribution and equity broking will remain unaffected.

Also Read: 6 Best UPI Apps For Safe Online Payments In 2024

The company also expects this action to have an impact of Rs.300 to Rs.500 crore on its annual EBITDA. Last month, Paytm reduced its workforce due to cost-cutting measures, with media reports claiming the layoff of more than 1,000 employees.

The latest curbs by RBI will definitely impact Paytm Payment Bank users, although normal Paytm users will remain unaffected. This is certainly a huge blow to the company and its image.

Are you looking to buy refurbished mobile phones? Cashify offers the best deals on refurbished phones with warranty support. Buy a refurbished and upgrade to a better smartphone experience!