If you have used online payment applications extensively, then you might have encountered the UPI system. The emphasis on a cashless economy has widened the scope of UPI payments even more. In this article, we bring you best UPI apps which are trending in 2025, and mention their key functionalities.

Our focus is to understand more about UPIs, the different functionalities we can use via these apps, and the best UPI apps you can download on your phone.

Also Read: Here Are Top 5 & Best Astrology Apps That You Can Count On

What Are UPI Apps?

UPI, or the Unified Payment Interface, lets you make online payments or cashless transactions straight from your mobile phone by adding multiple bank accounts to this app. Thus, it makes the process really convenient for users who hold multiple bank accounts but do not want to log in to their system or bank apps to make the payment.

With a single tap, you can check the remaining balance in your account, make payments by scanning the QR code, add accounts to your UPI app, and perform multiple other functions easily.

How To Choose The Right UPI App for You?

Go through these suggestions when you are choosing to use any of the UPI apps that will let you have a good experience with the app:

- Security: Check out apps with strong encryption and two-factor authentication for secure transactions.

- Features: Know which of the factors matters the most to you. They can be bill payments, recharges, in-store payments, or investment options.

- User Interface: Choose an app with a user-friendly interface that is easy to navigate.

- Brand Reputation: Opt for apps from reputable companies with a proven security and customer service track record.

- Rewards: Many UPI apps provide certain types of rewards to make transactions through their platform. Learn about the frequency and type of rewards like cashback, discounts, free subscriptions and so on!

Best UPI Apps In 2024!

| UPI App | Download Links |

|---|---|

| PhonePe | Android / iOS |

| BHIM App | Android / iOS |

| PayTM | Android / iOS |

| Google Pay | Android / iOS |

| Axis Pay | Android / iOS |

| CRED | Android / iOS |

| Freecharge | Android / iOS |

| iMobile App | Android / iOS |

| PayZapp | Android / iOS |

| Pockets by ICICI Bank | Android / iOS |

Also Read: How To Make Public Profile On Snapchat?

Best UPI Apps To Use Now!

Now, let’s examine the best UPI apps in detail to learn about the features offered by each option.

1. PhonePe

PhonePe is amongst the widely used UPI apps in the country that is available in eleven Indian languages making it highly accessible for people from different regions. The UPI app performs all the tasks of normal UPI apps and has an additional benefit. PhonePe comes with its own wallet that one can use to add money for instant payment from the application.

It began in 2015 and is among the first major players in the market that has held the domain of online transactions tightly.

Key Functionalities:

- Instant payment

- Checking account balances

- Add money to PhonePe wallet from the bank account or via credit or debit card

- All your favourite apps in one corner

- One of the best security systems in use

Also Read: Unlock Snapchat Account Using These Simple Ways!

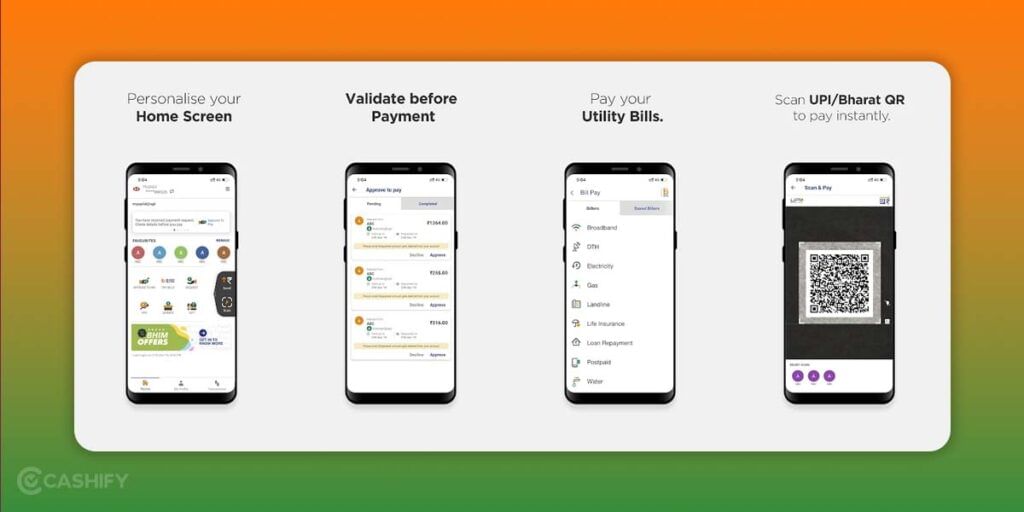

2. BHIM App

The BHIM app, launched by the National Payments Corporation of India to promote a cashless economy, is currently helpful. The app supports twenty languages, making it more convenient for users from different geographical regions and penetrating UPI usage in remote regions.

Key Functionalities:

- Backed by the guidance of RBI

- Validate your payment before finalising it

- 20+ languages supported

- Send money by adding the account number and IFSC codes

- No additional charges or transaction fees

Also Read: Need A Snap breakup? Here’s How To Delete Snapchat Account!

3. PayTM

PayTM has been a market driver in attaining merchants’ confidence in online transactions. This is quite evident as Paytm has become synonymous with online transactions for small businesses such as local groceries, clothing, hardware shops, and more. The payment is secured on the triple layer, giving enhanced protection while making an online transaction.

Key Functionalities:

- Superfast UPI payments

- QR code payments readily available at the merchant’s shop

- Get offers, cashback, and reward points on the transaction made

- Advanced triple layer of security

- Paytm UPI Lite makes a quick transaction that never fails, even during peak hours

Also Read: 5 Best Instagram Reels Editing Apps That You Cannot Miss

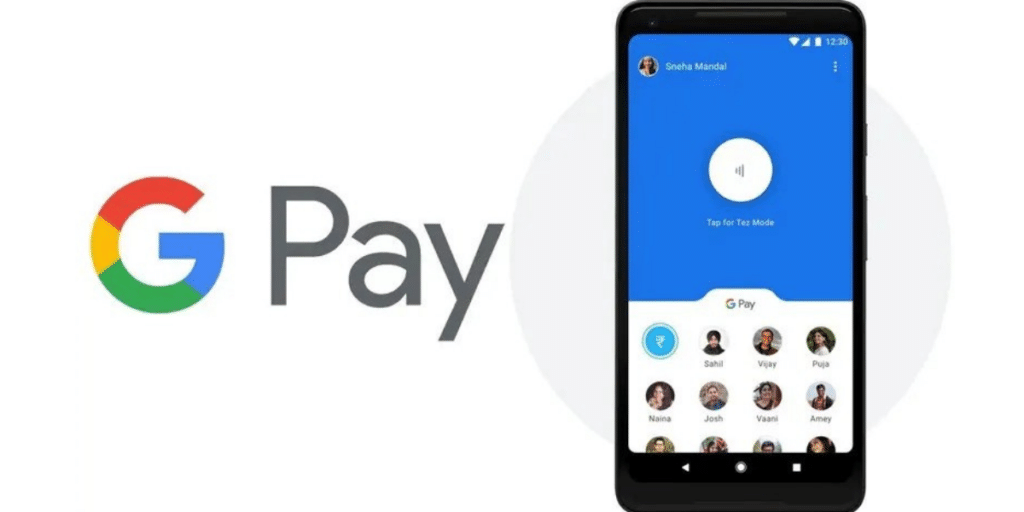

4. Google Pay

Powered by Google, the transactions on Google Pay are really quick. Frequently used merchant and payment contacts pop in the centre of your screen on this best UPI app in India to make payment easier. You even receive instant coupons for the transactions made, if applicable. You can even share the payment receipts from the transaction log. If the payment has failed and the amount got debited from your account, you need to wait until the amount has been credited. This is reflected in the logs, too.

Key Functionalities:

- Get exclusive offers on the app

- Get rewards for the previous transactions made

- Send money to family and friends

- 100 million registered users on the platform

- Reliable and trustworthy

Also Read: Get 1000+ Free Followers On Instagram In 5 Minutes! Here’s how

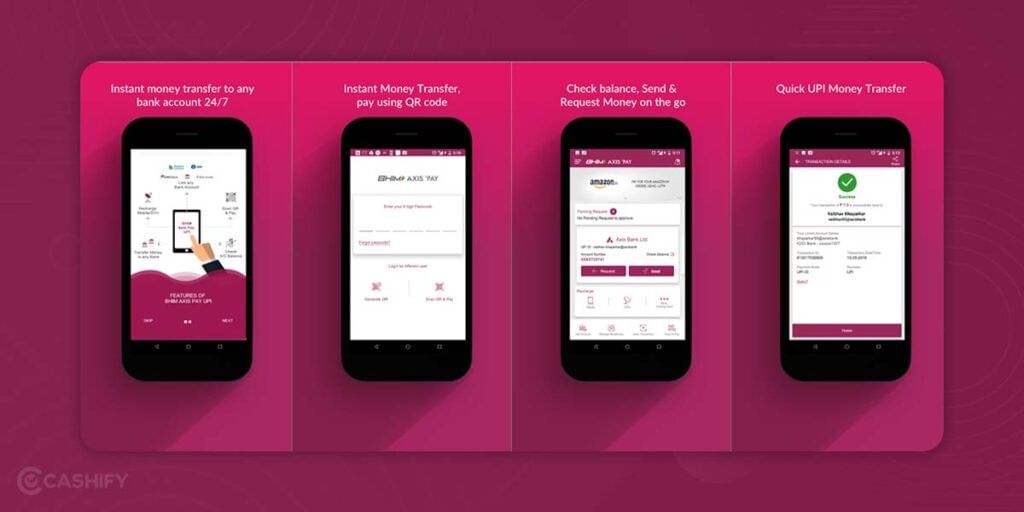

5. Axis Pay

Axis Pay ranks among the best UPI apps in the country for the ease of sending money to a payee without adding multiple account details. A VPA or Virtual Payment Address can be added to the application to help perform online transactions instantly. Even if you don’t have your account in Axis Bank, it’s still okay to continue using their UPI service by adding bank accounts from the different service providers.

Key Functionalities:

- Transactions can be done 24×7

- No need to register the payee

- Make direct payments via VPA

- No transaction charges

- Safe and securely done in collaboration with UPI

6. CRED

CRED is one of the best UPI apps that you will ever need for all your payments. You can use the app to scan & pay at stores or anyone via UPI, pay utility bills, credit card bills, monthly rent, and more. You can also get 100% cashback when using the app and use CRED Coins to win exclusive rewards, amazing prizes, and offers.

Key Functionalities:

- Easy UPI payments

- With the app, you can split bills and pay

- UPI security and privacy

7. Freecharge

Freecharge is another best UPI app in India that offers safe and seamless online payments. It is a 100% subsidiary of Axis Bank and has over 100 million users across the country. Freecharge provides a secure transaction experience for UPI users, powered by Axis Bank, with no delays or failures. Users can create a unique UPI ID linked to their bank accounts to make secure payments. The app allows users to transfer money, pay bills, recharge mobile/DTH, and invest in digital gold, among other features. Freecharge also offers cashback rewards and exclusive deals for users.

Key Functionalities:

- Freecharge provides Buy Now Pay Later options and personal loans determined by CIBIL scores.

- Small businesses can utilise Freecharge to distribute gift cards to customers and send payment reminders.

- Freecharge extends banking services, aids in managing financial goals, and provides financial ratings.

8. iMobile App

iMobile Pay is a UPI app offered by ICICI Bank that provides secure and seamless online payments. It offers over 400 banking services and is accessible to both ICICI Bank customers and non-customers. Users can create a unique UPI ID linked to their bank accounts to make secure payments. This best UPI payment app allows users to transfer money, pay bills, recharge mobile/DTH, and invest in digital gold, among other features.

Key Functionalities:

- Effortlessly acquire tickets for events, movies, and various other activities.

- Conveniently recharge DTH, mobile phones, and other services.

- Easily settle credit card dues, rent, and utility payments.

- Explore potential investments in gold, stocks, and mutual funds.

9. PayZapp

PayZapp, from HDFC Bank, is the best UPI payment app that’s great for getting cashback and rewards when shopping online. It comes with a virtual Visa debit card that makes paying online super easy. The app is also working on a new feature for making payments using sound, just like Google Pay. Plus, you can use PayZapp to pay on almost any e-commerce site in India and transfer money using VPA ID or QR codes.

Key Functionalities:

- Cashback and rewards on online purchases.

- Virtual Visa debit card for online payments.

- Supports VPA ID and QR code money transfers.

- Future feature: payments using soundwave technology.

- No need to reload money once your card is linked.

10. Pockets by ICICI Bank

Pockets by ICICI Bank is a simple UPI app that also works as a digital wallet. It’s easy to open a new savings account with Pockets, and you get a free virtual Visa debit card, with the option to order a physical card too. This is the best UPI app in India, which is user-friendly and allows quick money transfers using VPA ID or QR codes. It also supports contactless payments through a cool tech called Audio QR, and it offers some great deals right in the app.

Key Functionalities:

- Free virtual Visa debit card, with an option for a physical card.

- Contactless payments with Audio QR technology.

- Quick money transfers via VPA ID and QR codes.

- Easy access to exclusive deals.

- Manageable through ICICI Bank NetBanking.

11- Amazon Pay UPI

Amazon has also recently made its mark into the UPI services. Amazon Pay UPI is Amazon’s integrated payment interface, used for shopping, online payments, third-party transactions, and more. It allows users to make payments wit h either their Amazon account, using digital wallets, or by linking their bank accounts just like other UPI services. Moreover, it also supports bill payments, mobile recharges, and in-app purchases with cashback offers.

Key Functionalities of Amazon Pay UPI:

- Allows seamless integration of Amazon account and Bank accounts.

- Can be used for instant payments.

- Provides the most cashback offers and rewards.

- Suitable for voucher/third-party payments.

- Allows all kinds of bill payments.

- Supports advanced security.

Also Read: 5 Best Job Search Apps That Can Increase Your Chances Of Getting Hired 10x

Popular Comparisons of UPI Apps

PhonePe vs Paytm

| Point Of Comparison | PhonePe | Paytm |

| User Interface | More funky and clearer UI | Cluttered due to variety of features |

| Financial Features | Almost all types of transactional features options | Comparatively more number of transactional offerings. |

| E- Commerce Integrations | Limited e-commerce features; primarily focused on payments. | Extensive e-commerce platform (Paytm Mall) with a wide range of products. |

| Cashback and Rewards | Yes. You get multiple cashbacks and rewards. | Paytm also provides multiple cashbacks and rewards. |

| Referral Program | Yes | Yes |

| International Transactions | Currently does not support international transactions or cross-border payments. | Allows users to send money to bank accounts abroad. (Terms applied) |

Google Pay vs PhonePe

| Point of Comparison | Google Pay | PhonePe |

| Launch Year | 2018 | 2016 |

| Financial Features | Almost all types of transactional features options | Almost all types of transactional features options |

| Digital Wallet Integration | Does not support digital wallet support. | Supports digital wallet support. |

| UPI Transactions Volume | Second/third all over India | First all over India. |

| Support | Available for both iOS and Android | Available for both iOS and Android |

Final Words: Best UPI Apps To Use

According to data quoted by The Economic Times, around 52 percent of digital transactions are carried out using UPI.

Considering the popularity of all the apps that made it to our top UPI apps in India currently, it won’t be wrong to say that you can start using the platform hassle-free right now.

Pro-tip

As our article proceeds to the end, there is one pro tip that we would love to give our users who are newbies to UPI apps or otherwise. If you make a payment using the app and it fails, never panic and end up opting for advice from any third-party websites asking you to follow certain steps and call a particular number. You might be scammed. However, you can directly rely on technical help on the UPI apps by calling their customer service (provided on the app) or via mail to explain your problem.

Also Read: 5 Best Call Recording Apps That You Cannot Miss

FAQs

Which UPI server is best?

Among India’s safest UPI payment apps, PhonePe, Google Pay, Paytm, BHIM UPI, and Amazon Pay are considered the best choices. These apps have robust security features and are widely trusted by users for their reliability in handling UPI transactions.

Which bank is best for UPI?

HDFC BANK LTD stands out as the top choice for UPI transactions due to its impressive debit reversal success rate of 98.73%.

Which is the government UPI app?

The official UPI app backed by the government is Bharat Interface for Money (BHIM). BHIM is specifically designed to offer a simple and secure platform for making UPI transactions.

Can we use two UPI apps?

Yes, using multiple UPI applications on the same mobile device is possible. Users have the flexibility to install and link more than one UPI app, allowing them to manage transactions across different bank accounts or utilize specific features offered by each app.

Which bank has the highest UPI failure rate?

Among banks with notable UPI failure rates, Andhra Bank leads with a failure rate of 15%, followed by Indian Bank with 10.28%, Allahabad Bank with 6.83%, Union Bank of India with 4.2%, and Bandhan Bank with 3.58%.

Who is the owner of RuPay?

RuPay, India’s domestic card network, is owned and operated by the National Payments Corporation of India (NPCI).

Which UPI app is better?

Users often prefer Google Pay for its swift transactions and convenient features among the various UPI apps available. With its user-friendly interface and proximity functionalities, Google Pay stands out as a top choice for those seeking seamless digital payments.

Which is the official UPI app?

The official UPI app recognized by the National Payments Corporation of India (NPCI) is BHIM (Bharat Interface for Money). BHIM is developed on the Unified Payments Interface (UPI) framework and offers a secure and trustworthy platform for conducting digital transactions.

Which UPI app has the highest limit?

Google Pay boasts the highest UPI transaction limit, allowing users to transfer up to ₹1 lakh (Rs 100,000) daily across all banks. Additionally, new users can initiate transactions of up to ₹5,000 within the first 24 hours. This higher transaction limit enhances flexibility and accessibility for users.

Buying refurbished mobile phones was never this easy. Sell your old phone and get exclusive offers & discounts on refurbished mobiles. Every refurbished phone is put through 32-point quality checks to ensure like-new standards and comes with a six-month warranty and 15-day refund. Buy refurbished phone easily on no-cost EMI today!