It’s 2025, and everybody now has UPI apps to make or receive payments. I was waiting at the signal this morning on my way to the office. I saw a guy selling coconuts. He had a scanner displayed at multiple places. I observed that almost everyone who got a coconut from that guy used his scanner to make payments. Nobody was using cash. This is the new reality that we live in.

If I recall, a few days ago, I was on my way to my place. I offered the Auto driver cash. He said, ‘Ma’am, can you please do UPI?’. This is also a reality. People now prefer to go cashless. But what can we do to make this rewarding every time we make a payment? Many apps offer cashback when you make a transaction on their platform. I use a few of them personally, and I receive enough cashback to cover my monthly recharge expenses. Haha! Let’s look at the best option:

Also Read: Best 4K Projector In India: Theatre-Like Experience At Home

Common Ways You Get Cashback From UPI

Different UPI apps give cashback in different ways. Here’s how it usually works:

1. Scratch Cards:

Apps like Google Pay and PhonePe give you digital scratch cards. You “scratch” them after making a payment, and you might win some random cashback amount. It’s a fun, game-like way to get rewards.

2. Wallet Credit:

Apps such as Paytm and Amazon Pay add the cashback directly to your wallet inside the app. You can use this money for mobile recharges, shopping, or paying bills.

3. Direct Bank Credit:

Some apps, like BHIM and other government-supported ones, send the cashback straight to your bank account. This gives you more flexibility because you can use the money anywhere.

So, now lets find out which UPI App gives which cashback and which is the best to avail maximum cashback.

Best UPI App For Cashback

Let’s check out the full list of best UPI apps for cashback in India.

1. Super.money

Super.money is my first preference when it comes to making payments. It is fast, simple to use, and you get cashback consistently. The concept is more interesting as it offers ‘real monetary cashback’ which you can redeem. It does not offer any vouchers or coins and I feel that’s more practical and Best UPI App for Cashback.

Top Features

- Up to 5% cashback on every UPI transaction, regardless of the amount.

- Lifetime free RuPay credit card integration. (e.g., 2% on UPI merchant payments, 3% milestone rewards for spending over ₹1.5 lakh annually).

- Joining bonuses, such as Rs. 250 for new users via referral links.

- Clean, simple user interface for fast payments.

- Supports P2P transfers, merchant payments, and QR code scanning.

- Plans to offer credit cards and personal loans with minimal paperwork.

Pros And Cons

| Pros | Cons |

|---|---|

| High cashback rates without minimum spend | Still in beta – features may change |

| Fast and smooth app experience | Fewer merchants supported than apps like Paytm |

| Cashback goes straight to your bank (no coupons) |

Also Read: Nothing Phone 3 vs Phone 2: Should You Wait to Upgrade? (Early Look)

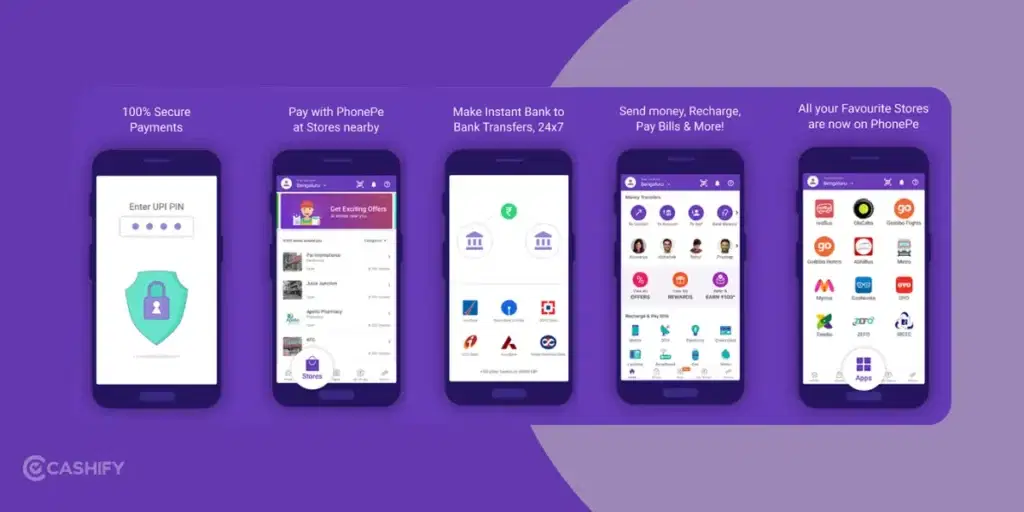

2. PhonePe

PhonePe is one of the most reliable apps in the Indian market. The best part about this is the widespread merchant acceptance. What’s even better is the amount of cash back one can earn on this platform. Whether it’s promo offers, scratch cards, or more, you can earn cash back in various ways. Totally deserves a spot in the Best UPI App for Cashback list.

Top Features

- Up to Rs. 2,000 monthly cashback through promotional offers and scratch cards on transactions, recharges, and bill payments.

- Scratch cards for mobile recharges, FASTag, and merchant payments.

- Referral programs giving cashback for inviting friends.

- Supports UPI, credit/debit cards, and PhonePe Wallet

- Supports 11 Indian languages.

- You can make mutual fund investments, insurance, and ticket bookings.

Pros and Cons

| Pros | Cons |

|---|---|

| Rs. 1 lakh limit, reliable transactions | Cashback offers not consistent |

| Works at many merchants (QR payments) | App can feel heavy or complex |

| Secure login (2FA + biometrics) |

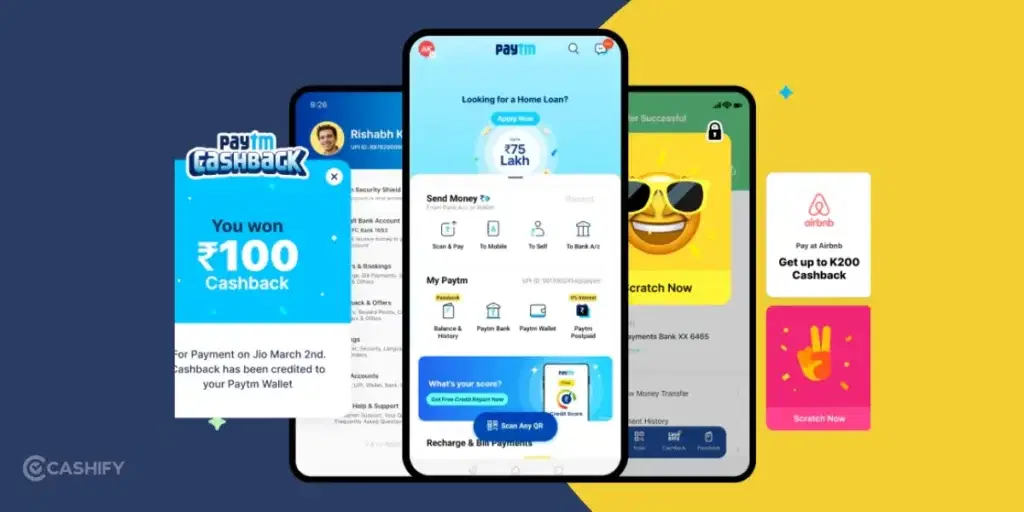

3. Paytm

Paytm I feel is the most popular app as it all started there for a lot of people. Even more me, Paytm was the first UPI app that I started using. It had games where you had to collect items by making payments. It features an even more robust offline merchant payments system.

Top Features

- Up to Rs. 3,000 monthly cashback on services like bill payments, recharges, and shopping on Paytm Mall.

- Assured Rs. 100 cashback on UPI payments for new users.

- Cashback on bus ticket bookings and money transfers.

- Supports QR code payments, P2P transfers, and ticket bookings (movies, flights, trains).

- Paytm Wallet and Paytm Postpaid for flexible payments.

- Partnerships with banks like YES Bank, Axis Bank, HDFC Bank, and SBI

Pros And Cons

| Pros | Cons |

|---|---|

| Widely accepted for offline payments | Cashback limited to certain services/merchants |

| Offers extra services (insurance, gaming, etc.) | App can feel cluttered with promos |

| Great for RuPay credit card users |

Also Read: Apple’s WWDC25 5-Day Event Confirmed For June 2025: Check All Details!

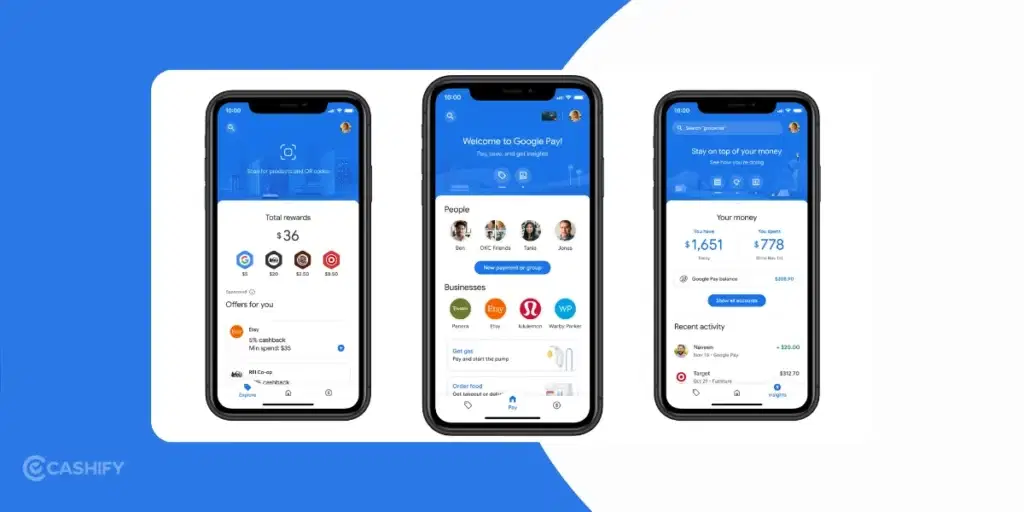

4. Google Pay (GPay)

GPay is another popular app that is mainly known for its scratch cards and amazing coupons. I love this app because I get coupons for OTT memberships, beauty deals, and more. Surely deserves a mention in the Best UPI App for Cashback list.

Top Features:

- Scratch cards and vouchers for transactions, bill payments, and gaming deposits. (e.g., Khiladi Adda).

- Referral bonuses and cashback on UPI transfers, often ranging from Rs. 5 to Rs. 200.

- Supports NFC-based tap-to-pay and seamless integration with Google services.

- Bill payments, recharges, and expense tracking.

- High security with two-factor authentication and biometric login.

Pros And Cons

| Pros | Cons |

|---|---|

| Fast, reliable transactions | Cashback in vouchers |

| Wide merchant acceptance | Less consistent rewards |

| Clean, ad-free interface |

Also Read: Best 100Mbps WiFi Plans: Top Options Explained!

5. Amazon Pay

I find Amazon Pay the most convenient if you frequently shop at Amazon. You can collect coupons and receive cash back accordingly. It is one of the best UPI apps for recharges and shopping.

Top Features

- Cashback on Amazon purchases, bill payments, and recharges. You can get up to Rs. 200 to Rs. 500 during campaigns.

- Exciting offers like Rs. 250 Amazon gift cards for tap-and-pay transactions.

- Quick Checkouts

- Supports bill payments, recharges, and insurance purchases.

- High security with encrypted transactions and fraud detection.

Pros and Cons

| Pros | Cons |

|---|---|

| Good for Amazon cashback | Limited to Amazon & select merchants |

| Reliable payments | Fewer rewards for non-Amazon users |

| Multi-language support |

Also Read: Samsung Galaxy S25 Edge Vs Pixel 9 Pro Camera Comparison: Which Takes Better Photos?

6. CRED App

CRED is a financial rewards app that gives users points and cashback for paying their credit card bills on time. Instead of offering cashback for every UPI transfer, it focuses on rewarding responsible financial behaviour.

Top Features

- Earn CRED Coins every time you pay a credit card bill through the app.

- Redeem coins for:

- Cashback rewards (through lucky draws and contests like Kill the Bill).

- Brand vouchers and discounts on shopping and lifestyle offers.

- Premium subscriptions and gift cards.

- Participate in campaigns such as Pay & Win or Jackpot to win direct cashback.

- Use CRED Pay and CRED Flash for faster checkout and added rewards.

Pros and Cons

| Pros | Cons |

|---|---|

| Earn CRED Coins for every on-time credit card bill payment. | Works mainly for credit card bills, not regular UPI transfers. |

| Redeem coins for cashback, gift vouchers, or premium offers. | Cashback is not guaranteed; often depends on lucky draws. |

| Track multiple credit cards and get payment reminders. | Only available for users with a credit score of 750+. |

| Access to exclusive deals, rewards, and partner offers. | Not useful for those who don’t use credit cards regularly. |

Let’s Summarise It…

Let’s quickly get an overview for the best UPI App for Cashback in India.

| Category | Top Apps |

|---|---|

| Cashback (Direct) | Super.money, MobiKwik |

| Cashback (Vouchers) | Google Pay, PhonePe |

| E-Commerce | Amazon Pay |

| Merchant Reach | Paytm, PhonePe |

| P2P/Specific Use | Super.money |

| Best UI | Google Pay, Super.money |

| Cluttered UI | Paytm, PhonePe |

| Top Security | Amazon Pay |

| Extra Features | PhonePe, Paytm |

Super.money is the best in a lot of ways. After that, I’ll suggest you should also have the BHIM app. It’s not known for cashback or rewards. However, BHIM is the most secure option available, as it is backed by the government and its servers are always up. It’s just in case of an emergency when no other app is working.

If you use credit cards a lot, you can also check out CRED app. It can give good cashback offers.

You might like these too:

Final Thoughts

In the end, I can only say that you should always keep multiple apps on your phone and keep exploring the best offers. You can use Super.money for consistent rewards, BHIM for security, and Amazon Pay for shopping rewards. You can also earn by referring these apps to your friends and family.

Did you know that refurbished mobile phones cost at least 10% less than new phones on Cashify? You also get other discounts, No-cost EMI and more, making it the most affordable way to buy a premium phone. So, what are you waiting for? Buy refurbished mobile phones at your nearest cashify store and avail exclusive offers.