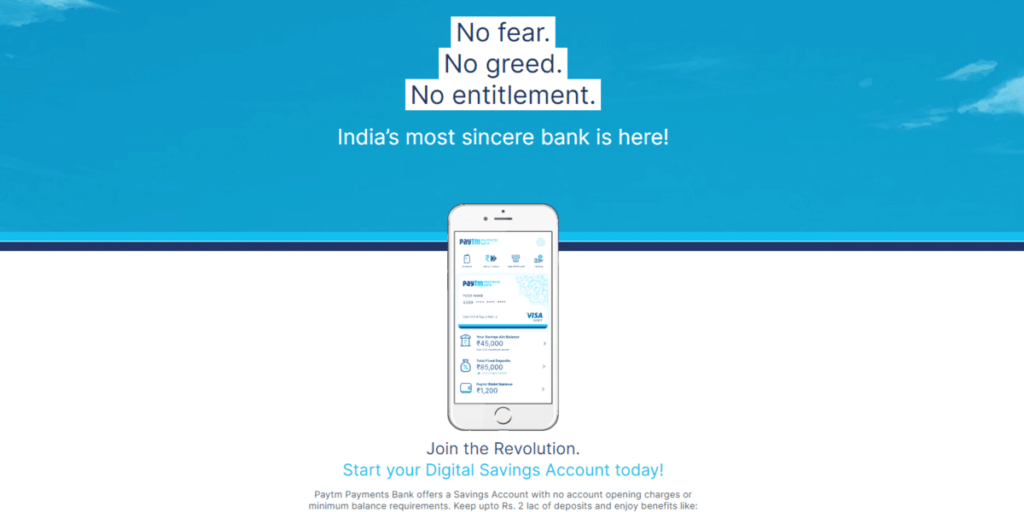

The Reserve Bank of India has directed Paytm Payments Bank from opening their doors to any new customers. This move by RBI was initiated today itself, that is, March 11 2022. There are a multitude of different reasons that my be directly responsible for this ban. From KYC (Know Your Customer), data privacy convers and outsourcing of data, many of these factors caused this, according to experts.

This is the second time in a while that Paytm has been in the not-so-good news category. Back in 2020, Paytm Payments Bank was removed from Google Play Store. This was primarily because Paytm reportedly violated Google Play Store’s gambling policies. However, this time, things may be a little more complex than they may seem.

Also read: Huawei Nova 9 SE Launched: Price, Specifications And Other Details

RBI Bans Paytm Payments Bank

This is actually not the first time that Paytm Payments Bank from absorbing new customers. Way back in 2018, Paytm had to stop with their enrollment of new customers for RBI had noticed had something fishy. That was in relation to how Paytm adheres to its KYC procedures and onboarding new customers. This time, the situation may be the same. However, the complexity of it is what does not allow us to pinpoint the exact reason.

Also read: Amazon Fab Fest Sale Begins: Know Details Here

RBI took to their official website to declare that Paytm will have to appoint an IT audit firm. With this comprehensive audit, the loopholes will be brought to light, if any. The Reserve Bank of India is seriously buckling up to create a foolproof digital space for the security of Indian citizens.

What More?

The RBI release reads as, “Onboarding of new customers by Paytm Payments Bank Ltd will be subject to specific permission to be granted by RBI after reviewing report of the IT auditors. This action is based on certain material supervisory concerns observed in the bank.”

Furthermore, Yogesh Pirthani, partner at ELP, said that, “It is very clear that the RBI has concerns with the IT system of Paytm Payments Bank. Data privacy, KYC, data storage these are RBI’s core issues. The RBI has instructed MNCs to have their data centres in India and that is why American Express was also barred. RBI has very clear guidelines on data centre, data storage, data outsourcing etc.”

It will be interesting to see how Paytm Payments Bank crawls out of this one for this will hinder their growth plans for 2022 big time.

Also read: iPhone SE 2022 Score’s Impressive On Geekbench Listing