UPI (Unified Payment Interface) has made our lives easier when it comes to making cashless transactions. In fact, sleeping in mind the ease of usage for the consumers, it is one of the best, easiest, and safe ways to transfer and receive money directly from one account to another. As it becomes more of a necessity, here we bring you a guide to activate UPI using Aadhar.

Nearly many individuals and businesses around us have started using it, motivating more cashless payments. Activating UPI is very easy and can be done in a few simple steps through the registration of your bank details. To date, it was only possible to activate UPI via debit card details. Well, now, users can activate UPI using their Aadhar card details linked to their bank account, so requiring your debit card details to activate the payment interface isn’t a necessity anymore. In this article, we tell you how to activate UPI using Aadhar.

Also Read: How To Improve Video Quality On WhatsApp?: 8 Tricks To Know!

What Is UPI?

UPI stands for Unified Payments Interface. Developed by the National Payments Corporation of India (NPCI), it is a real-time payment interface. Person-to-person or person-to-merchant-based payments can be facilitated on it. Payments via UPI can happen via mobile devices. Hence you can easily send and receive money anywhere, anytime.

Payments using the interface can happen instantly. Be it day or night, you can perform UPI payments anytime you need. UPI payments are secure as well. A specific PIN is required to initiate payments. No important details of the parties paying or receiving money are shared with either side or revealed online to an external source. Payments via UPI are accepted by various businesses, shops, and services, thus making it a one for all payment service.

Also Read: What Is WhatsApp HD Images: Game Changer For Image Sharing In 2023

Steps To Activate UPI Using Aadhar

Below mentioned steps can be used to activate the UPI using Aadhar and make it convenient for user who do not have access to debit cards for entry.

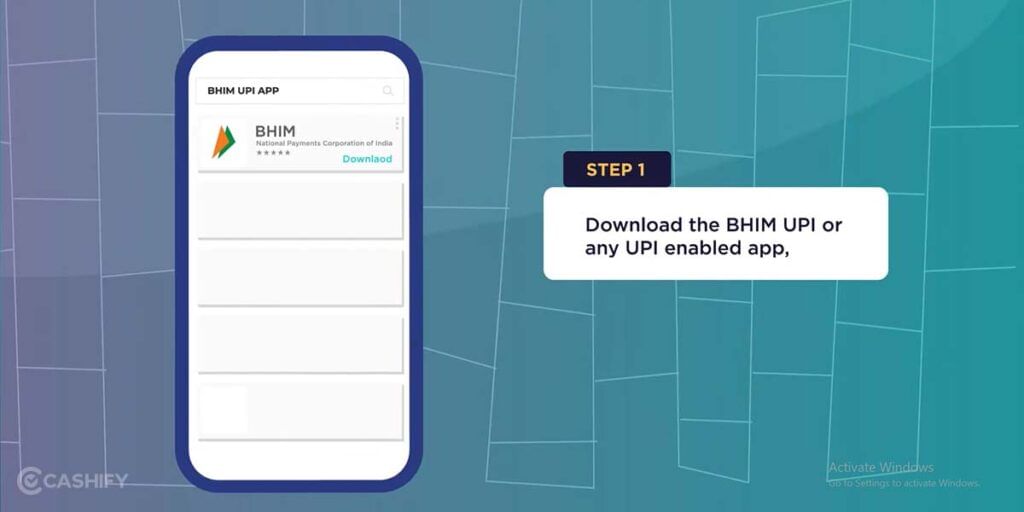

1: Download the BHIM UPI or any UPI-enabled application (Gpay, PhonePe, etc.) from the Google Play Store or the App Store. Create an account for payments

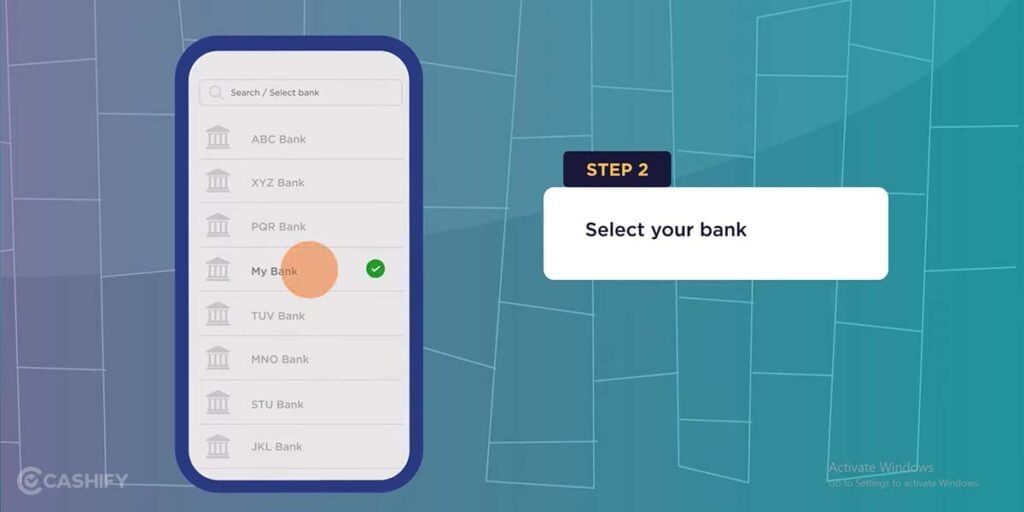

2: Choose your bank linked to your mobile number and tap on Next.

3: Set a new UPI PIN on the UPI App

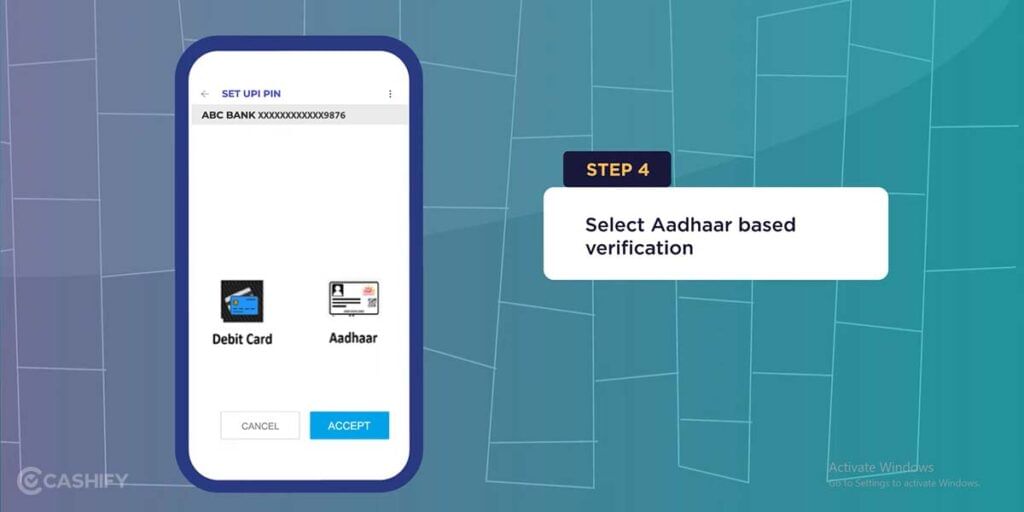

4: Tap the option for Aadhar-based verification

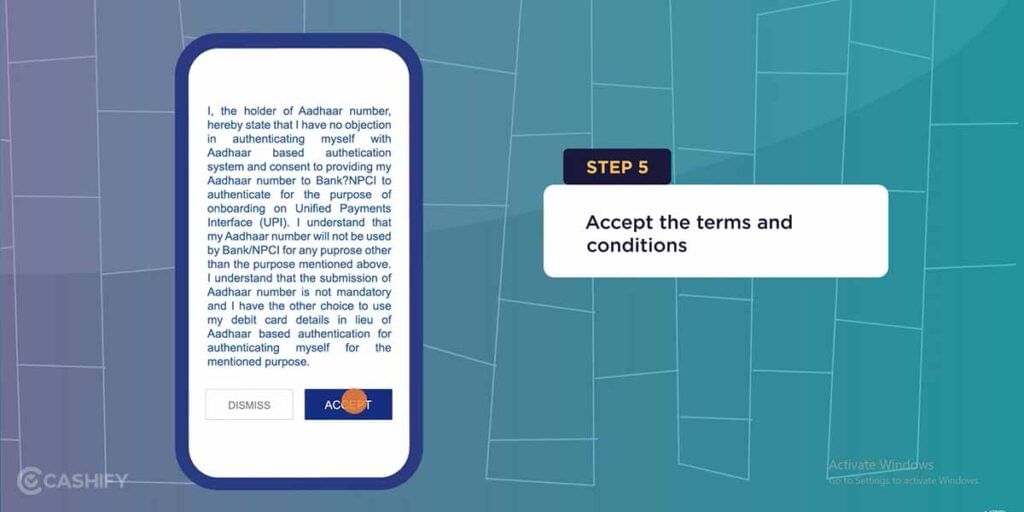

5: Accept the terms and conditions

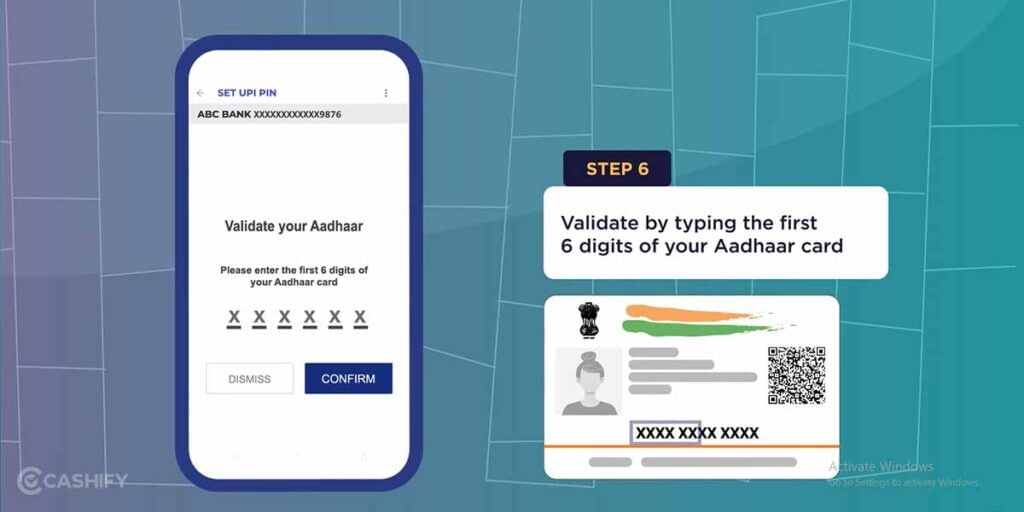

6: Verify your Aadhar by inputting the first six digits of your Aadhar number and tapping on confirm.

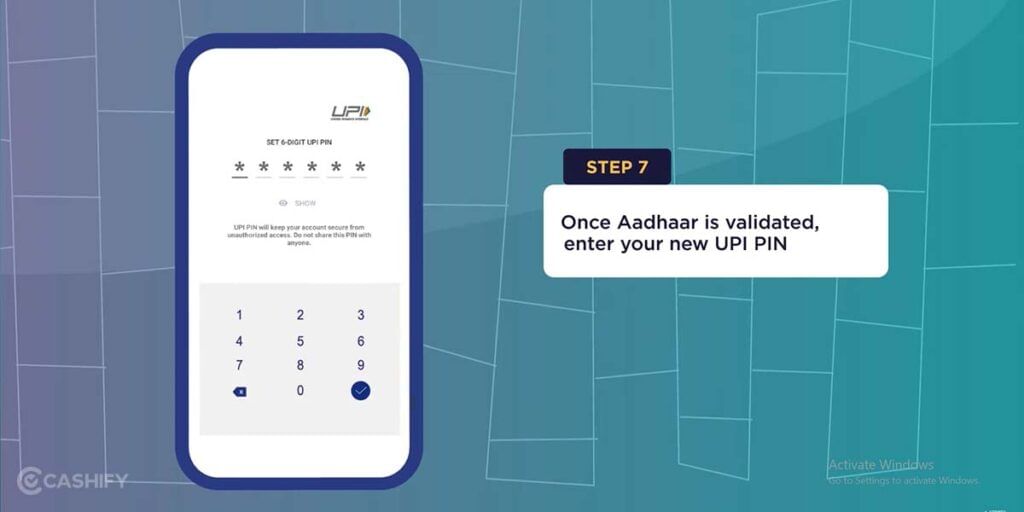

7: Once your Aadhar card has been verified, you can now enter your UPI PIN.

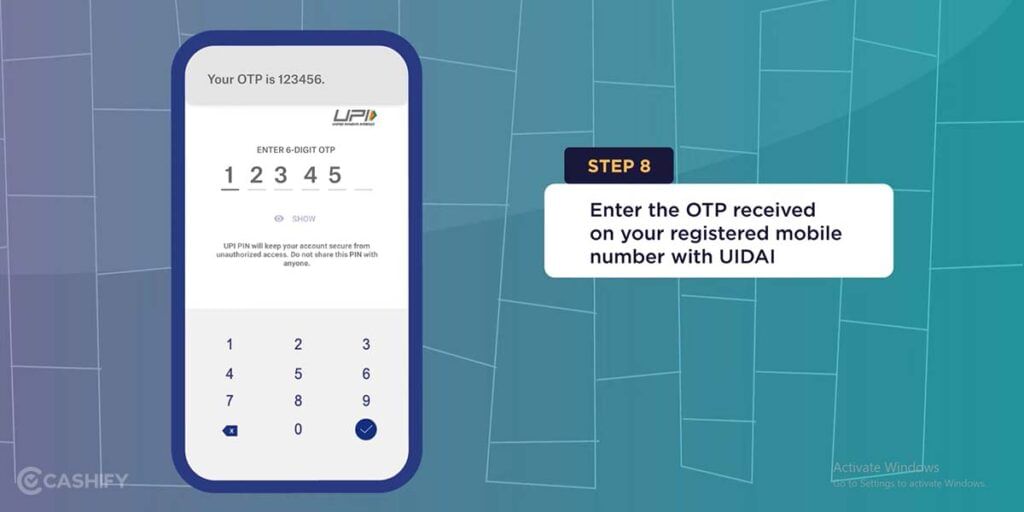

8: Enter the OTP received on your registered number with UIDAI

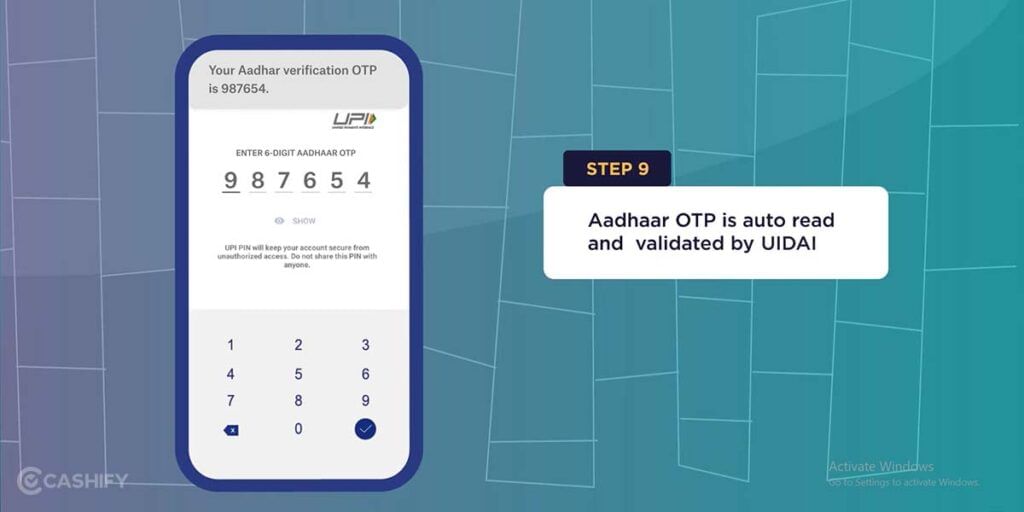

9: UIDAI will automatically read and validate the Aadhar OTP.

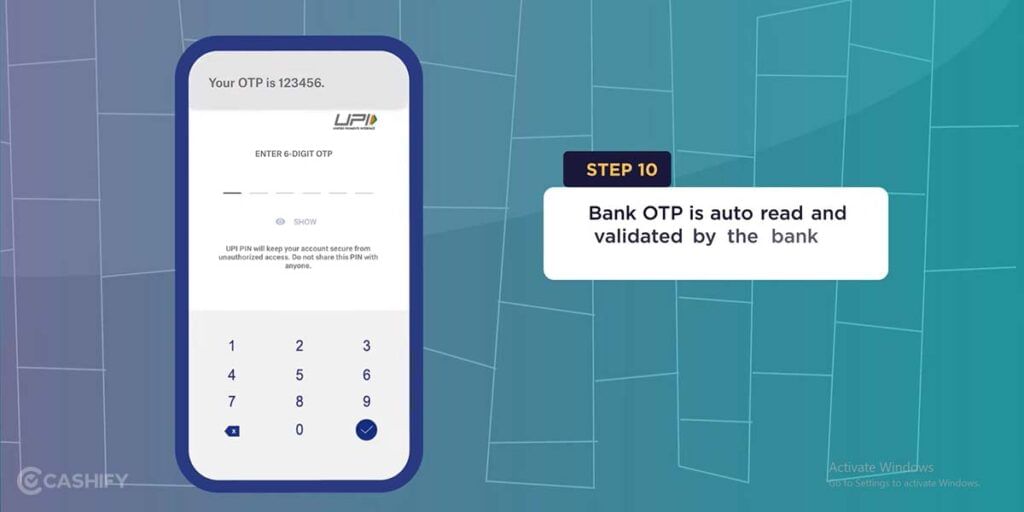

10: The Bank will also automatically read and verify the OTP for Bank account verification

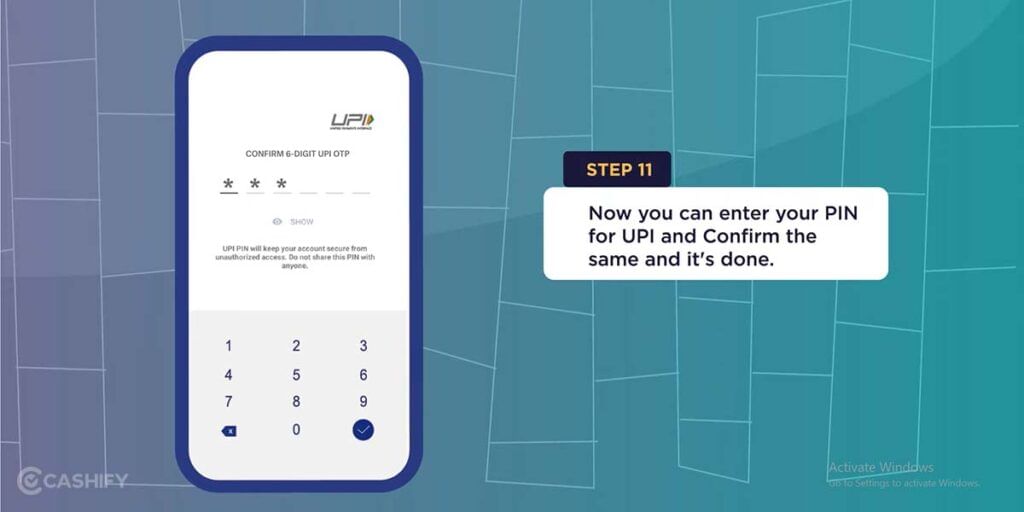

11: You can now enter your UPI pin for confirmation and complete the process.

You can now pay and receive money via UPI post-activation.

Also Read: Apple Games Porting Toolkit: All You Need To Know!

How Does Linking UPI With Aadhar Help?

Linking your Aadhar with UPI adds an extra layer of security to your payments. Aadhar is a twelve-digit unique identification number that is unique for every individual; Linking Aadhar will add more protection to your UPI payments.

Besides, it also eliminates the requirement for a debit card. Users can directly send and receive money without the need for a debit card. Activating UPI is now a much easier and simpler process one can use the Aadhar linked to their bank account instead of providing debit card details.

Payments on Aadhar linked UPI will also reduce frauds and scams due to the unique properties of the Aadhar number.

Also Read: What Are WhatsApp Channels For Broadcast?

Benefits Of Using UPI For Payments

- UPI payments are very convenient when it comes to payments. Any user using the interface can make payments to other users, irrespective of their bank account, in an instant.

- Payments done on UPI Apps are safe. Users need to input their UPI PIN to initiate payments. The user’s bank account details are never exposed, and privacy is maintained.

- Transactions on most UPI payments are free. There is no service charge on UPI payments.

- UPI payments can be done anytime, anywhere, provided users have active internet connections.

- Users can also link multiple bank accounts to their UPI ID so users can choose which bank account can be used depending on the transaction.

- People can use any device like a laptop, tablet, or smartphone to perform payments, making it convenient for a wide variety of users out there.

- It’s beneficial for businesses to set up one valid account to perform business activities and maintain transactions effectively in a unified manner.

Also Read: 4 Best Scratch Resistant Phones To Buy In 2023

Synopsis: Activate UPI Using Aadhar

The NPCI has made a really useful initiative through the introduction of cashless payments via UPI. The UPI payment experience has now been further enhanced with the addition of Aadhar-based verification. This will benefit users who don’t have a debit card or access to one. People in rural areas especially would appreciate and use this way of payment system. No need for debit card details for setting up a UPI as one can now do it simply with their Aadhar details linked to their bank account.

Also Read: 4 Best AI Apps To Convert Speech To Text In 2023!

You can sell phone online or recycle old phone with Cashify. Avail best prices and get the process completed at your doorsteps.