The Reserve Bank of India (RBI) recently directed the suspension of Paytm Payments Bank, citing persistent non-compliance. The restricted services of the bank barred users from depositing any fresh money to customer accounts, wallets and FASTags with the suspension of other banking services.

However, existing users can withdraw the amount from Paytm Wallet until February 29th but can’t load any money thereafter. This has led customers to look out for Paytm Payment Bank Alternatives that can cater to their needs.

What Happened to Paytm Payments Bank?

Recently RBI audit discovered an alarming flow of unaccounted money between Paytm Payments Bank and its parent company One97 Communications. This lead to RBI investigating money laundry concerns and there were reports that there have been multiple instances of failure to meet compliance set by RBI.

For those unaware, in October 2023, Paytm Payments Bank faced regulatory action for non-compliance with Know Your Customer (KYC) regulations. The bank authorities failed to properly conduct KYC of certain bank accounts and some of the accounts were registered without doing KYC. There were thousands of bank accounts with fake KYC details along with a single customer holding multiple bank accounts using the same KYC details. This raised concerns about money laundering and financial fraud.

The regulator expressed concerns about overlapping management that raised conflict of interest, where top executives held decision-making positions in both entities. Also, there were a bunch of alleged transactions that were non-compliant and the Payments Bank was found negligent in flagging such transactions.

The RBI discovered that Paytm Payments Bank had also been guilty of exceeding regulatory limits. The bank violated the daily allowed end-of-day balance for specific customer accounts. It was also reported that the bank showed inability to address security threats and delayed cybersecurity reporting of certain incidents that lead to compromised data.

Also Read: Best App To Invest In Mutual Funds In India

Top Paytm Payment Bank Alternatives in India!

This ban on the Payments Bank has led to customers worried, and they can safely withdraw their funds. But if you are one such user of Paytm Payments Bank, and are on the lookout of alternatives then there are 5 alternatives that you can try right now and migrate your funds.

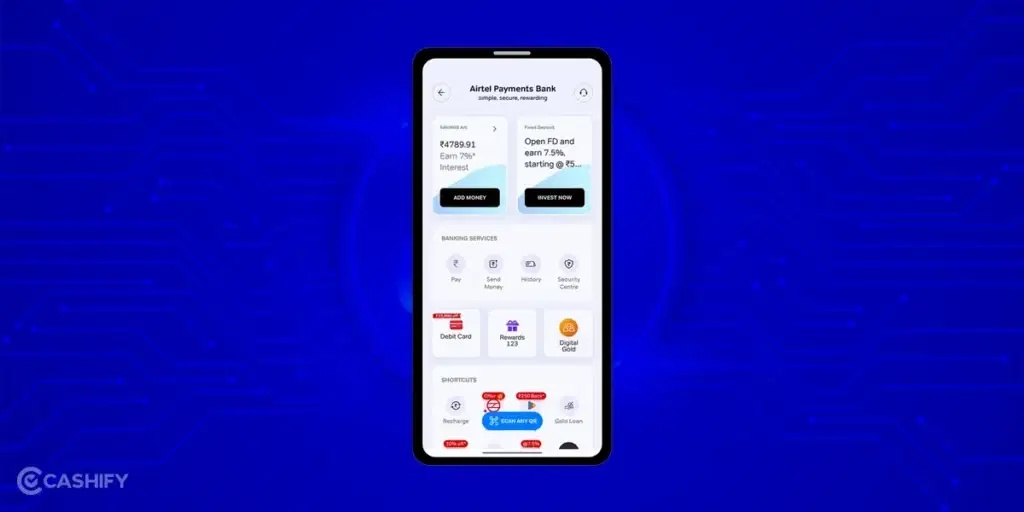

1. Airtel Payments Bank

Airtel is one of the older digital banks and is well-trusted by users. It was initially quite popular amongst Airtel users. Now, in recent years has grown its user base beyond the saturated AIrtel user base. Licensed by the Reserve Bank of India, it provides services such as FasTAG, UPI, Utility bill payments etc. You can even buy Digital Gold and park your spare funds in Fixed Deposits with interest rates upto 7.5%.

The Airtel bank simplifies account opening through Video KYC. It requires you to submit your Aadhaar card and hold an active mobile number. Additionally, the app also features a digital wallet allowing users to manage finances, and mobile recharges, pay bills, shop offline, send money, and make online payments across various platforms.

Airtel Payments Bank offers zero-balance savings accounts, that eliminate minimum balance requirements. Users can use UPI features seamlessly on all platforms and can also scan and pay for their transactions.

Furthermore, Airtel’s Rewards123 program provides cashback benefits on various transactions, including mobile recharges, online purchases, and bill payments. This program adds another layer of value for users and is exciting to lure customers to use the platform.

2. Jupiter

Jupiter is another compelling contender in the digital banking space, offering a zero-balance savings account in partnership with Federal Bank. The digital bank offers digital KYC services that can get you started within minutes and you get a zero-balance bank account that requires no minimum balance maintenance.

With the App you can leverage the use of UPI services that QR code scan and pay functionality. Along with this you can pay your credit card bills, and other utility bills within the app itself. The user interface is well-built and users can gain valuable insights into their spending habits through the integrated finance tracking feature. Additionally, Jupiter offers a RuPay Credit Card and a free VISA debit card for everyday transactions that can be used to withdraw money from ATM or swipe at card machines to pay for transactions.

Similar to Google Pay rewards, Jupiter’s rewards system allows users to earn “Jewels” on their spending that can be redeemed for cash, gold and other rewards. To make transactions secure Jupiter has established partnerships with financial institutions like Axis Bank, NPCI, RuPay, and VISA.

With the Jupiter app, you can invest in financial products like Mutual Funds, Gold and even open Fixed Deposits with interest as high as 7.5%.

Also Read: How to Transfer Amazon Pay Balance To Bank Account

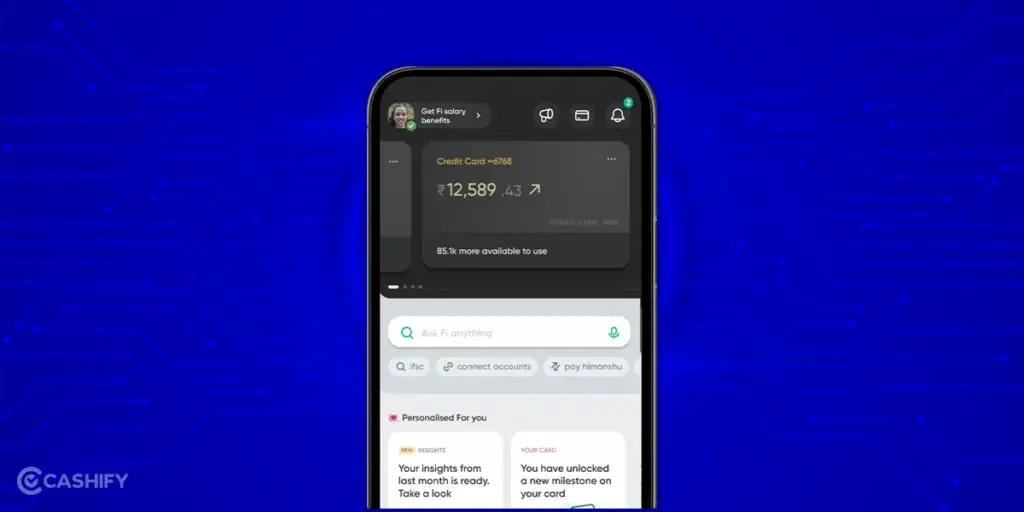

3. Fi Money

Fi Money is a payments management platform that lets you open an online savings bank account, UPI payments, Mutual funds, Loan and invest in US stocks. You even get a digital VISA debit card, and you can even request for physical debit card. The Fi Money app is well-built and is one of the best Paytm Payment Bank alternatives.

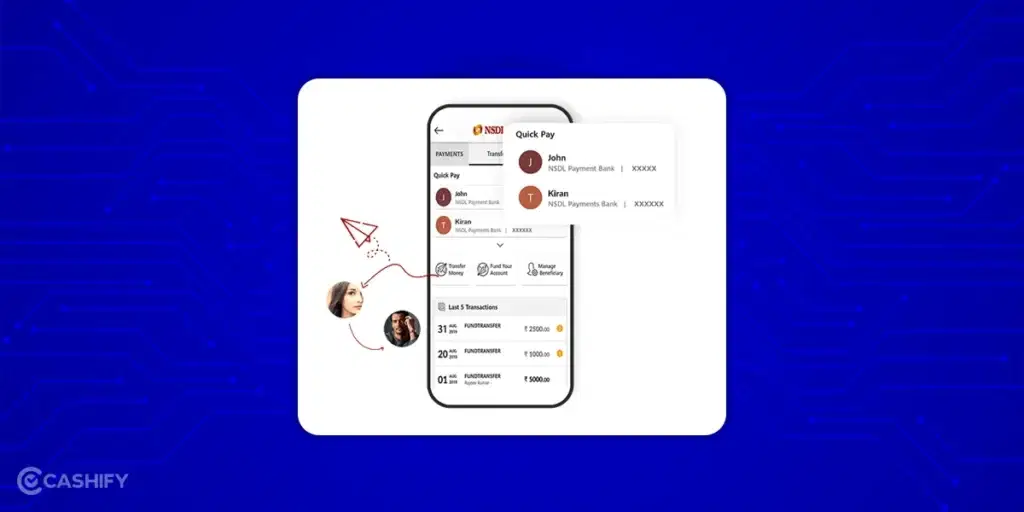

4. NSDL Payments Bank

NSDL Payments Bank, with its NSDL Jiffy platform, offers simplified banking solutions. Operating under a license granted by the Reserve Bank of India, the bank focuses on providing core banking services. The account opening process is simple and can be opened online with just an Aadhar card, PAN Card and phone number.

The Bank offers savings as well as current account service, offering competitive interest rates. Users also get a free virtual debit card, while physical debit cards incur an annual fee of Rs 300. The banking services include domestic money transfer, investing in mutual funds directly and you can even link your trading account for investment experience.

Also Read: How Can You Open an Airtel Payment Bank Account without Airtel SIM

5. Kotak’s 811

The Kotak 811 Zero Balance Savings Account is slightly different from the regular Kotak bank account and can be opened entirely online. But some features are limited. The bank account is a zero balance account and the app offers tons of services. These include UPI services, UPI Lite support, NEFT, IMPS payments and more.

Users can easily shop online using either their Virtual Debit Card (VDC) which is provided for free and users can opt for a physical debit card. However, please note that the physical debit card has an annual fee of Rs 299.

The bank is offering lucrative interest rates and provides 4% interest on savings account balances above Rs 50 lakhs and 3.50% interest p.a. on savings account balances up to Rs 50 lakhs.

It’s important to note that other options exist in the digital banking space, such as Fi Money and IndusInd zero balance savings accounts. Exploring these alternatives can help you choose the banking solution that best aligns with your specific needs and are decent alternatives to Paytm Payments Bank.

Also Read: Make Google Pay, PhonePe, PayTm UPI Payments Without Internet

FAQS

Is Paytm Payments Bank shutting down?

Yes, Paytm Payments Bank can’t accept new users or deposits due to RBI restrictions for non-compliance issues. You can still withdraw your existing balance.

What happened to Paytm Payments Bank?

The RBI found concerns about money laundering and KYC violations at Paytm Payments Bank, leading to restrictions on their services.

Which payment bank is best?

There’s no single “best” option. Some popular choices include Airtel Payments Bank (zero-balance account, bill payments), Jupiter (zero-balance, investments), Fi Money (investments, US stocks), NSDL Payments Bank (simple opening, mutual funds), and Kotak 811 (interest on savings). Consider your needs like account fees, investment options, and debit cards when choosing.

Which app is better than Paytm?

Popular alternatives include PhonePe (leading UPI app, investments) and Google Pay (secure UPI, bill payments through partners).

Is Paytm banned in India?

No, Paytm itself is operational. However, Paytm Payments Bank’s restrictions prevent new users and deposits. You can still use the Paytm app for existing wallets and accounts but cannot add funds.

How easy is it to open an account with NSDL Payments Bank?

You can set up an account entirely online using just three documents, including your Aadhaar card, PAN card, and phone number. This eliminates the need to visit a physical branch, making it a convenient option.

It’s time to upgrade to a better phone. Sell old mobile phone and buy refurbished mobile phone from top brands like Apple, OnePlus, Samsung, Xiaomi and more at almost half price. Buy smart, buy refurbished.