Your CIBIL score is an imperative factor that lenders look at when evaluating your loan application. That’s why it is vital that you know how to check CIBIL score for free, how you can improve it, and the factors that affect your CIBIL score. Nowadays, most consumers turn to credit cards or loans to achieve their financial goals and dreams. In getting much-needed access to credit, the CIBIL score plays a major role.

As per the study, almost 74 per cent of Indians check their CIBIL score twice a year to apply for a new credit card or new loan. To be financially healthy, it is vital that you check your CIBIL report as a part of a credit health management exercise. In fact, it should be done on a regular basis.

However, before diving deep into the CIBIL score, let us first understand what CIBIL is and what CIBIL score is.

Also read: Best Personal Loan Apps For Easy Loan Approvals

What is CIBIL?

The full form of CIBIL is Credit Information Bureau India Limited. Now it is known as TransUnion CIBIL. It is a well-known Indian credit rating agency that reflects consumers’ creditworthiness.

What is a CIBIL Score?

A CIBIL score is Consumer’s credit score. In simple terms, it is a three-digit numeric representation and summary of the consumer’s credit history and a crystal-clear reflection of the person’s credit profile. The typical score ranges between 300 to 900.

Also read: 6 Best Credit Card Bill Payment Apps in India

What is a Good CIBIL Score?

A good CIBIL score ranges from 700 to 900 points. It demonstrates to the lender that you are credit-ready and creditworthy. The below table represents what each CIBIL score means and the probability of its loan approval.

| CIBIL Score | Creditworthiness | Loan Approval Probability |

| <600 | Require urgent action | Low |

| 600 – 649 | Doubtful | Difficult |

| 650 – 699 | Fair | Possible |

| 700 – 749 | Good | Good |

| 750 – 900 | Excellent | Very High |

What is the Importance of a CIBIL Score?

Your CIBIL score plays a major role at the time of availing credit, especially for loan approvals. The score provides an idea to the lender about how much risk they will be taking by giving you the funds that you have requested.

If you have a CIBIL score above 750, it increases your chances of availing of the loan much faster and easier. In short, it increases your creditworthiness. If you have a bad credit score, there is a high chance that your loan will be rejected.

Your CIBIL score directly impacts the interest rate. If you have a good credit score, you will get a loan for a lower interest rate. On the flip side, a poor credit score won’t make you eligible for getting a loan at a lower interest rate.

Also read: How To Pay Credit Card Bill?: Easy Guide

Advantages of Having a Good CIBIL Score

A good credit score offers various advantages, such as:

- Low-interest rates

- Higher limits

- Higher approval chances

Factors That Affect Your CIBIL Score

Here are a few factors that can affect your CIBIL score.

Increased Credit Limit

The maximum amount that a borrower can spend using a credit card is called a credit limit. Usually, lenders set this limit as per the borrower’s capability to repay. If you spend more than 50 per cent of your credit limit, there is a high chance that your CIBIL score will suffer. It shows you are not good at managing money. So, keep your spending under 50 per cent of your credit limit.

Taking Multiple Loans

If you take multiple loans, your credit score will drop. It shows that you are not good at handling funds and are in dire need of credit.

Not Paying on Time

Your credit history plays a vital role in affecting your CIBIL score. So, always make payments on time to maintain a good credit score.

Unsecured Loans

When you have a high percentage of unsecured loans like personal loans or credit cards, it will drop your credit score. Therefore, try to balance by availing the combination of secured and unsecured loans. It will increase your credit score.

Also read: What Is Amazon Pay Later And How To Avail It!

How to Maintain a Good Credit Score?

Here are a few tips that you need to implement if you want to maintain a good credit score.

- Take one loan at a time.

- Whenever possible, try to make a part-prepayment.

- Pay your EMIs or credit card dues on time.

- Never spend over the credit limit. Keep your credit utilization ratio at 30 per cent or less.

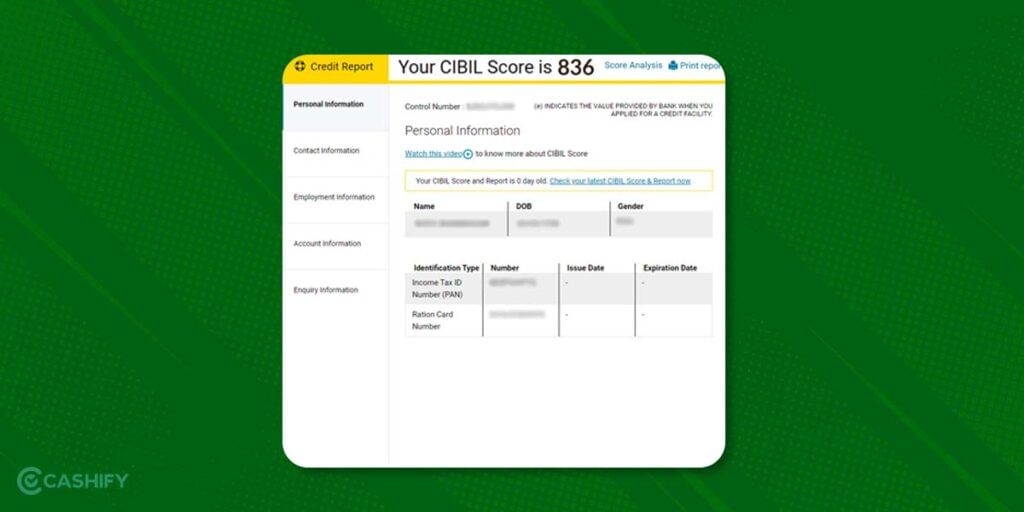

How to Check CIBIL Score for Free?

Here are a few steps that you need to follow to check your CIBIL score.

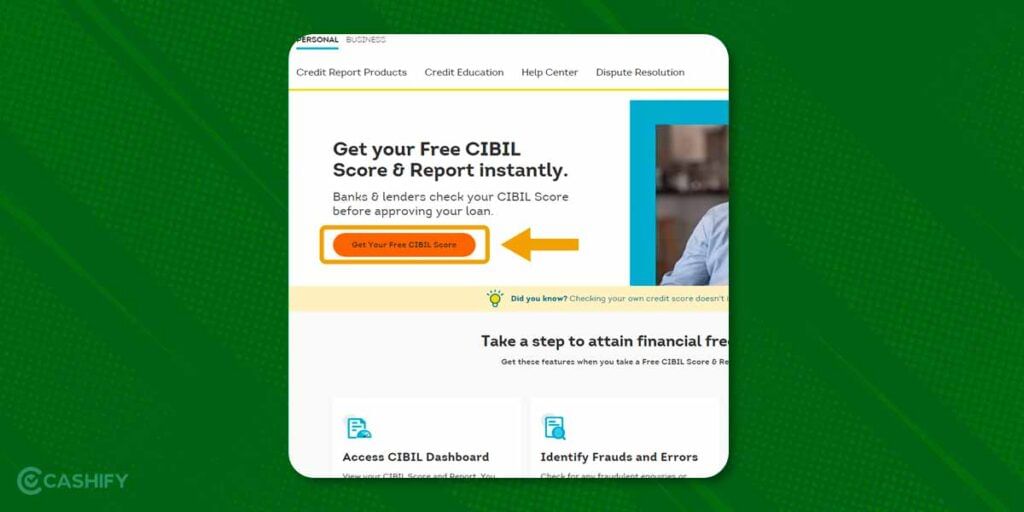

- Go to the official website of CIBIL

- Click on the ‘Get your CIBIL score’ button.

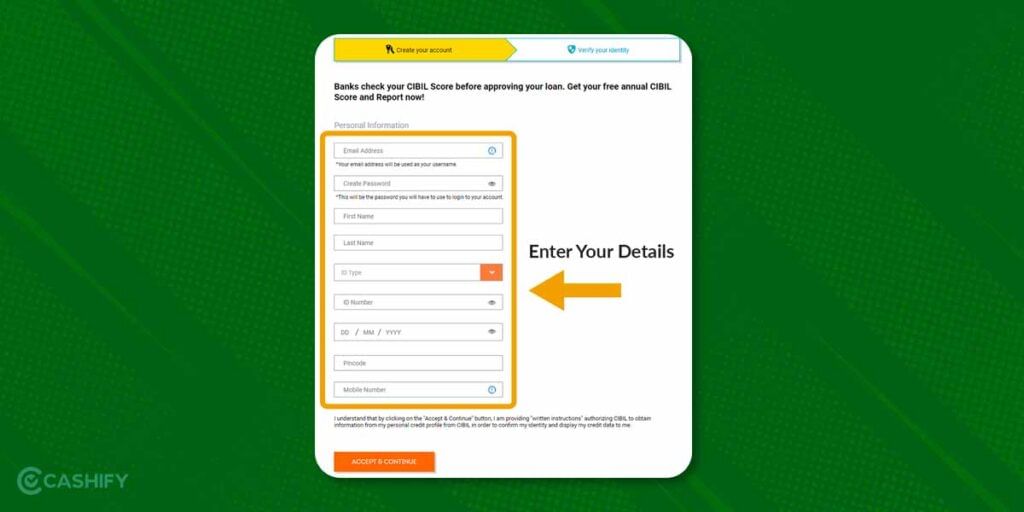

- Now, enter your personal details like name, email ID, phone number, PIN code, birth date, etc. After that, attach your ID proof.

- Click on ‘Accept and Continue.’

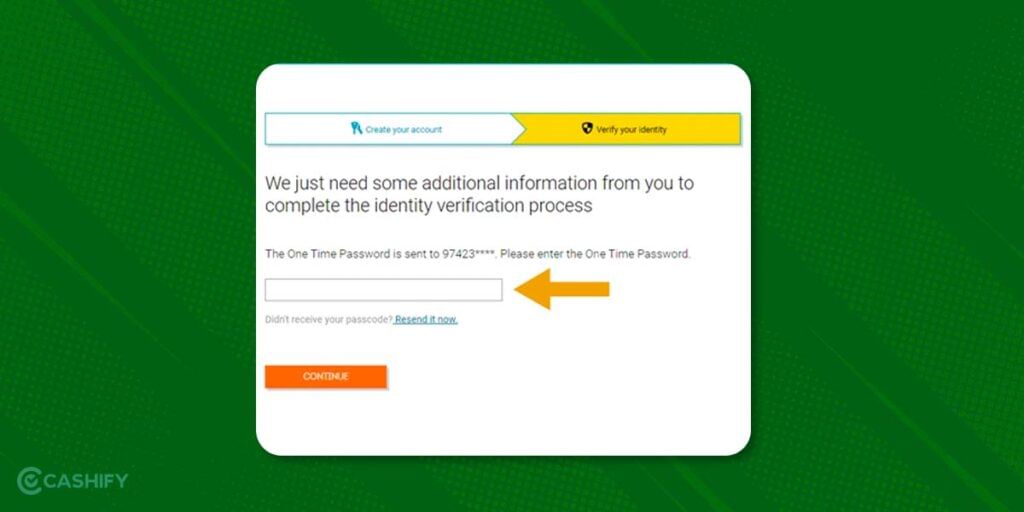

- Now, you will receive an OTP on your mobile phone. Enter that OTP and select Continue.

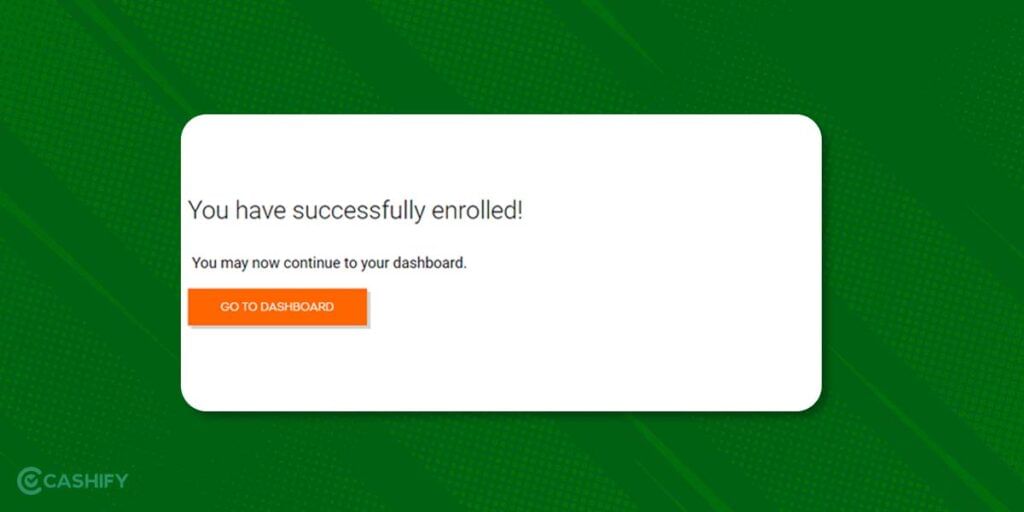

- Click on ‘Go to dashboard.’

- Now, you will be redirected to the website – myscore.cibil.com

- Choose the ‘Member Login.’

- Once you log in, you can check your CIBIL score.

Also read: How is Amazon Pay Later Different From Amazon Pay?

Final Thoughts

No matter whether you want to borrow for purposes such as education, marriage, home, or other things, maintaining a good CIBIL score will make you credit-ready when you need it the most. Hopefully, now you know how to check CIBIL score. So, ensure your monitor it regularly and start working towards improving it.

Also read: How To Link Credit Card With UPI?

Remember, a positive credit profile can increase your chances of getting a loan from the lender and pave the way for access to credit. Keep the above tips in mind to improve your CIBIL score if it is below average.

Happy Investing!

Do you want to get rid of your old phone? Sell your old mobile phone online or recycle your old mobile phone with Cashify. Cashify offers a quick sale and eco-friendly recycling.