Amazon is perhaps the most prominent e-commerce platform locally here in India and globally; they offer products in almost every significant segment and include many features and additional services for convenience. Amazon Pay is one such add-on feature the e-commerce giant offers to its customers to simplify spending and encourage returning customers. Amazon Pay is essentially a wallet allowing users to top-up using any payment method or even gift cards; this money can be easily used towards purchases made on Amazon in the future.

Also Read: How To Find Lost iPhone Online Easily And Track Its Live Location!

Amazon Pay is responsible for simplifying many payments on the website; they also come with a dedicated ICICI partnered Amazon Pay co-branded credit card in India. It offers a flat 5% cashback to all prime users who buy on Amazon. Amazon is usually at the top of the list when people purchase online, which stimulates more spending and more Amazon. It is a post-paid credit service that enables consumers to utilise the Amazon Pay Platform.

It also offers instant credit on all products up to Rs 60,000 as long as they are on Amazon. You can even use the credit amount to make payments for water, electricity, mobile bills, or purchase of groceries. Cash equivalents like jewellery, Amazon Pay Gift cards, and Top-up cannot be purchased using Global Store or Foreign merchants items. You can pay back the amount of credit in the subsequent month at no additional fee. You can easily divide it into EMI for up to 12 months at ease. There are no additional fees however there might be an interest of 1.5 to 2 per cent per month. In some cases, as indicated, certain products might be available with a no-cost EMI option.

Also Read: How To Save Battery Life On iPhone!

You can borrow up to Rs 10,000 for one month and pay it back the following month. 3 months tenure options are available between the amounts of Rs. 3,000 and Rs 30,000 and you will have an option to buy now or Pay later in EMIs. There are several other options ranging up to 12 months. With a minimum purchase amount of Rs 9,000 up to the upper limit offered to you based on your credit history.

Also read: Best Oppo Mobile Phones

Where to use it?

Because the prices of precious metal commodities fluctuate every day, Amazon India explains in its terms and conditions. You cannot use Pay later service to acquire gold and silver (bullion) or any jewellery. In addition, the value of currencies changes, you cannot use Pay Later to buy things outside of the U.S. Pay Later cannot purchase Amazon Gift Cards or transfer funds to the primary Amazon Pay balance. Because people could try to manipulate the system because of the different prices of different products.

Also Read:

6 Best Cheap Gaming Laptops to Buy in India

Features

- When the lender sees your credit limit, he or she will make an instant decision.

- There is no need to provide credit card information.

- It doesn’t cost anything to cancel or process.

- There are no fees before the sale.

- On Amazon, it’s easy to check out and get your money back quickly.

- You may pay later by using Amazon’s Pay Later feature.

- To keep track of your expenses and payments more quickly, use the EMI-specific dashboard to see how much money you have spent.

Also Read:

Maximize Your Work-From-Home Setup With 6 Best Laptop Docking Stations

Click here if you’re looking to sell phone online, or want to recycle old phone, and Cashify will help you get the process completed right at your doorstep.

According to reports, it is now allowed on shopping as well as bill payments, the service can also be used on all online and offline merchants where Amazon Pay is accepted, this includes websites such as Swiggy, ClearTrip, and BookMyShow. When it comes to eligibility, Amazon analyses your activity with Amazon Pay sellers, the marketplace, and more. The final decision still lies with the lender who decides by gauging your ability to pay back considering the common factors for any credit offered.

Also Read: How To Make Group FaceTime Calls On Your iPhone Or iPad

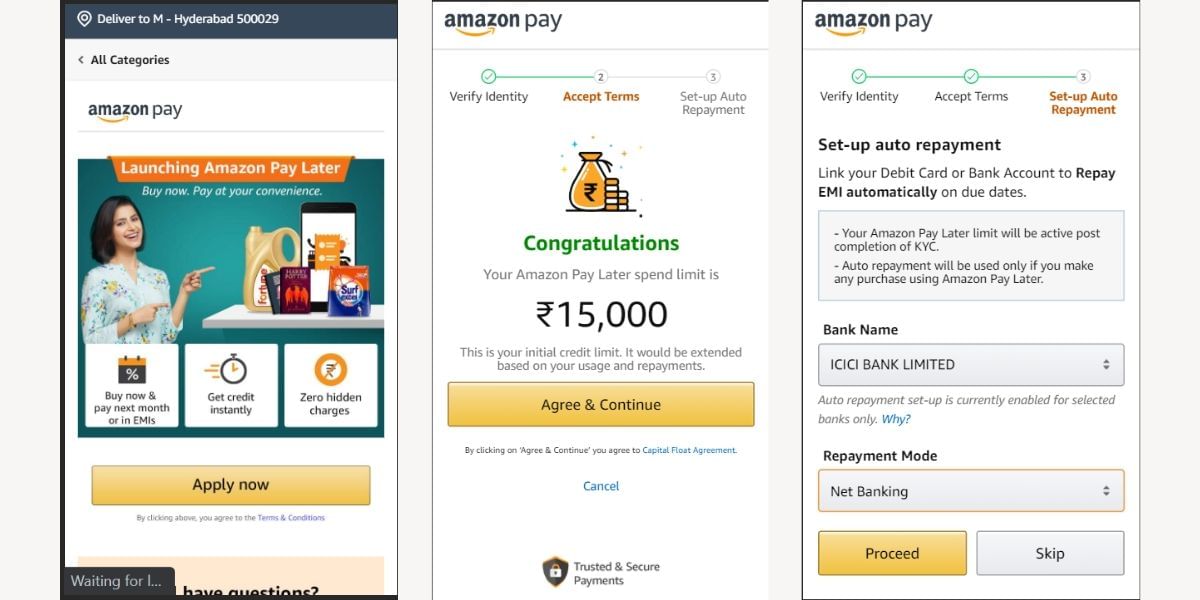

How to Apply and Avail Amazon Pay Later Service

- Start the process by visiting the dedicated registration page for the service on Amazon app or a browser

- Enter your details and fulfil the KYC formalities online to activate the Pay Later feature

- After successful KYC, the Amazon Pay Dashboard will show the registration status and you can see all your future transactions in this section

- You will need to furnish all the required details online and get your KYC approved to be eligible for Amazon Pay Later