The success of UPI has led to several players such as Google pay, PhonePe, Paytm, Amazon UPI and others enter the market to get a piece of the pie. Xiaomi also has its own payment service called the Mi Pay and is available for users in India with support for UPI. Xiaomi Pay comes with a lot of essential features and is very simple and friendly to use.

Mi Pay can be easily downloaded from the Mi App Store if you own a Xiaomi phone, for other users who want to try it, the application is also available on the Google Play Store so the application can be easily downloaded without having to offload the apk from unreliable sources.

Also Read: Keep Your Children Busy During Quarantine With These FREE iOS Apps

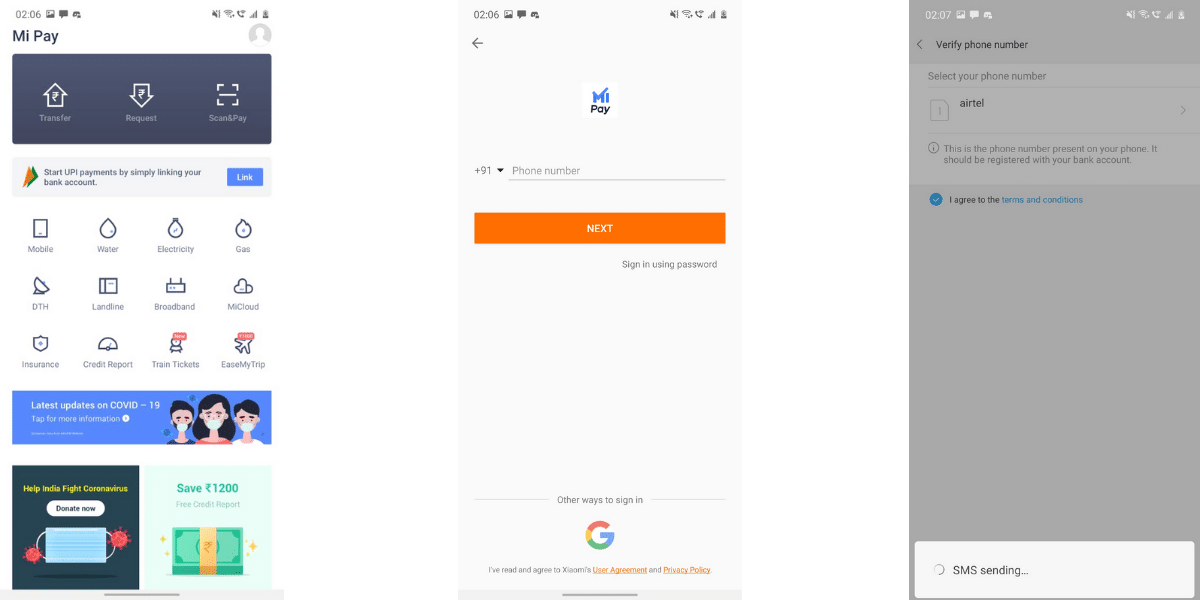

Once you have the app installed, getting the Mi Pay up and running should just take a couple of seconds, you will be prompted to log in to your Mi Account for the first time that you open the application, if you are using the App on ta Xiaomi phone then it is very likely that you already have a Mi account, there is also an option to quickly register for a new account if you did not create a Mi Account so far. The main interface of Mi Pay is straightforward and clean, on not Xiaomi phones you can even use your mobile number or your Google Account to sign in to the application which greatly adds to the convenience.

Also Read: Lockdown Remedy: Best Smartphones to Watch Netflix, Prime, and Hotstar

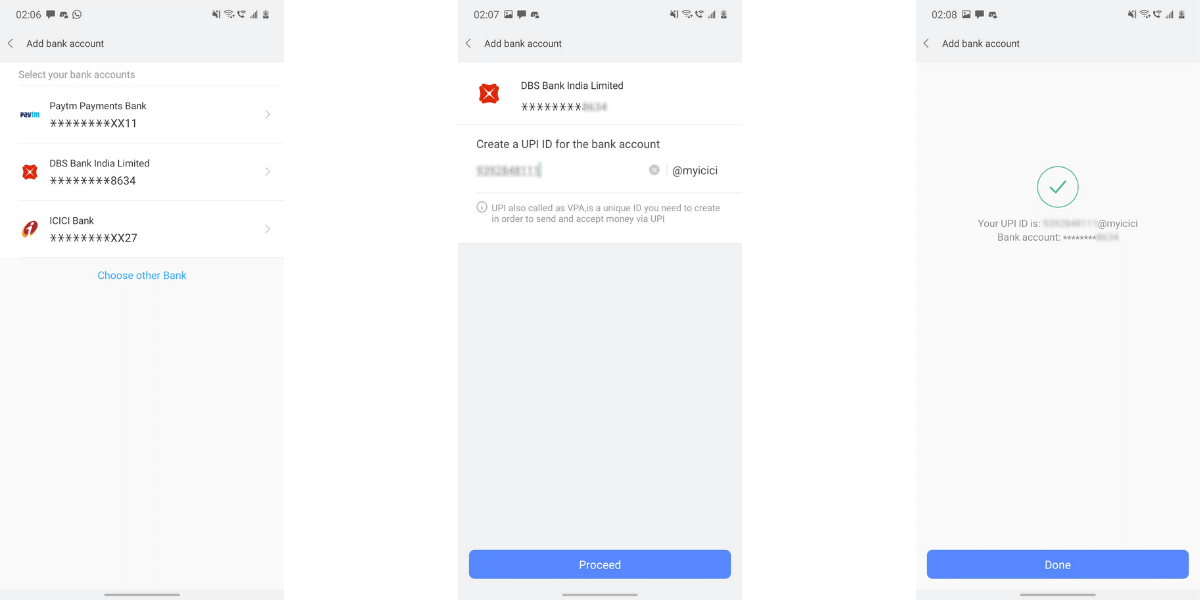

- Once you’ve successfully signed in to the application for the first time, it will ask you to add a bank account, click on the Add Bank Account button to proceed.

- In the next step, you will need to choose the SIM card to send the SMS form for authentication and the application will then send an SMS to their partners and fetch all the bank accounts registered to your mobile number.

- Then proceed to click on the bank account that you want to register on the application, this will then show the last four digits of your bank account number and ask you to proceed

- In the next step, you are prompted to enter your choice of UPI handle and if the handle is available, you can proceed with the registration

- Once you have successfully registered and linked your bank account with your new Mi Pay UPI ID, you are ready to make new transactions.

You can now proceed to share your new Mi Pay UPI ID with your friends to receive payments in the selected default payments account, or you can choose to make new payments using the application.

Also Read: Best Apps For Android And iOS To Help You Work From Home

To Make New Payments

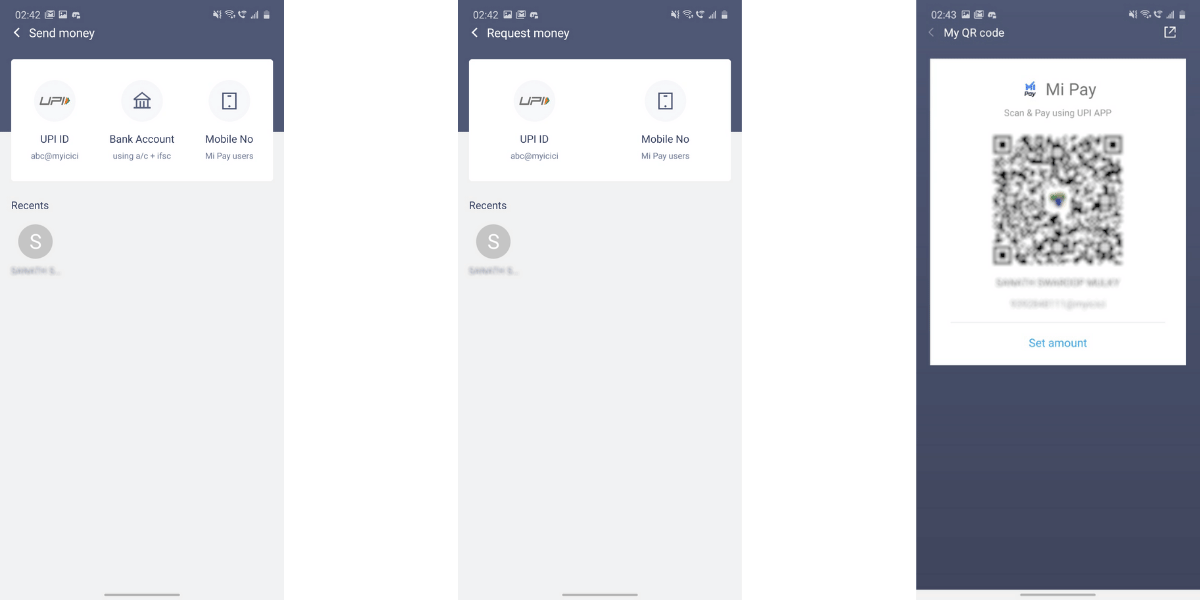

- Navigate to the home screen of the application, in the top row, you should find an option for Transfer you can choose this option to make payments to a mobile number, a UPI address or a bank account.

- If you are at a store and want to scan a QR code to make a payment, then you can select the Scan & Pay option and the application will open a QR code scanner

- After either scanning the QR Code or by selecting the UPI ID that you want to make the transfer to, the application will verify the UPI ID and display the name of the recipient above their UPI ID.

- In the next field, you will be asked to enter the amount of money that you wish to transfer and remarks if any

- Once you enter the amount and remarks, you can choose the default registered bank account or add another bank account that is registered to your mobile number, select the right option and hit the next button

- You are now taken to a confirmation page with the previously entered data and, verify that the details are correct and hit the confirm button

- You will now be prompted to enter your UPI pin which is handled by the UPI itself without interfering with the application

- After entering the correct UPI Pin, the transaction is authenticated and you are then taken to the success screen with the Transaction ID.

Also Read: Here Are Our Favourite Games To Play During the COVID-19 Quarantine

To Receive Payments using Mi Pay

There are two ways to receive payments on Mi Pay

- Using your Mi Pay QR Code

- Open the Mi Pay application and navigate to the home page

- Here click on the Scan & Pay option in the top row

- The application opens the QR scanner and shows a small option for “My QR Code”

- Select the My QR Code option and the application will show you the Mi Pay QR code for your account and you can pass it to your friends for an easy payment experience

- Using the Request Payment Feature

- Navigate to the home screen of the Mi Pay application and select the Request payment option

- Here, select the option to request by Mobile no or UPI ID,

- Enter the Mobile number or UPI ID of the user that you want to request payment from

- You can now select the amount that you want to request and the validity of the request

- Once the details are entered you are taken to the confirmation page and upon confirming, a payment request is sent to the user.

- Upon successful payment from the user, you are notified with the details on your Mi Pay account