Investing in Mutual Funds is the way to go if you want to stay financially stable. I’m not saying it; the economics experts are telling you this. However, investing any amount of money requires the right app, and with so many applications available, finding the best app to invest in mutual funds may turn out to be a hassle for users. But that’s why we are here: we might have found an app that can solve all your financial problems in one go.

Also Read: 5 Best Web Hosting Service That You Can Opt For

Best Apps To Invest In Mutual Funds

1. Coin by Zerodha

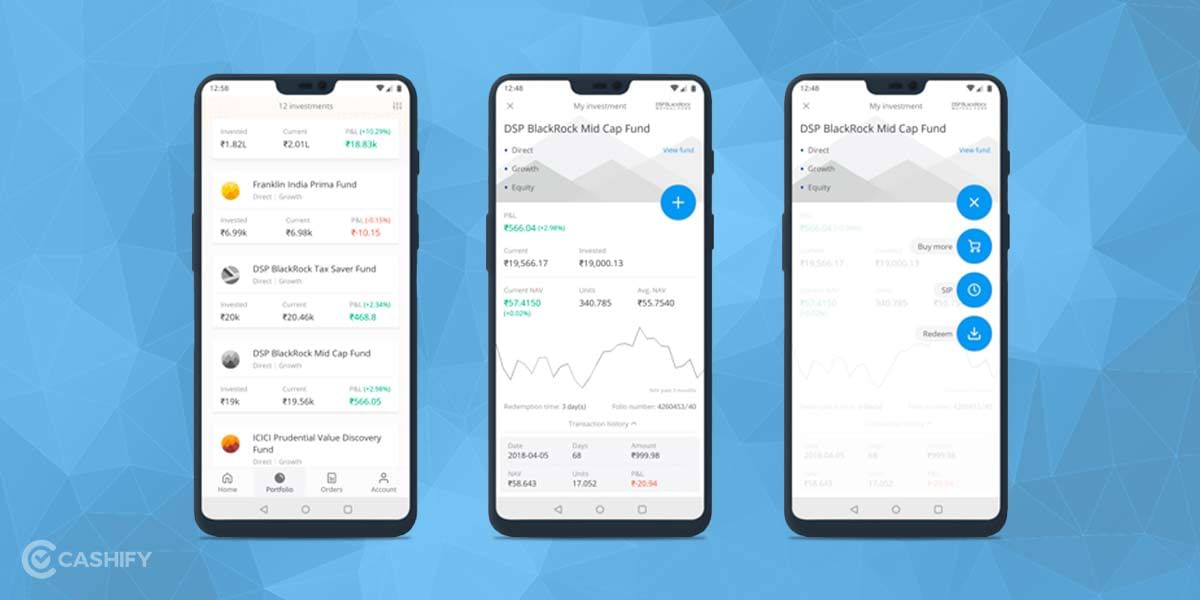

Zerodha is a well-known investment platform and probably the simplest app that can easily let you invest in mutual funds. In addition, the platform has a Coin application that is perfectly compatible if you already have a Zerodha account. So log in to your account using the app, and that’s it. You’re good to go.

Also Read: 9 Best AirPods Alternatives That You Can Buy In India

With this app, you can create your SIP anytime. In addition, it also lets you modify the SIP whenever you need to change any information. You can view various financial schemes, ELSS funds, and Tax filing instructions. The Coin By Zerodha app has a fine-tuned User interface in terms of app features. It is easy to use; most importantly, you can easily navigate between financial schemes and understand them with the dedicated investment calculator. With these features on board, Coin by Zerodha might be the best app for investing in mutual funds.

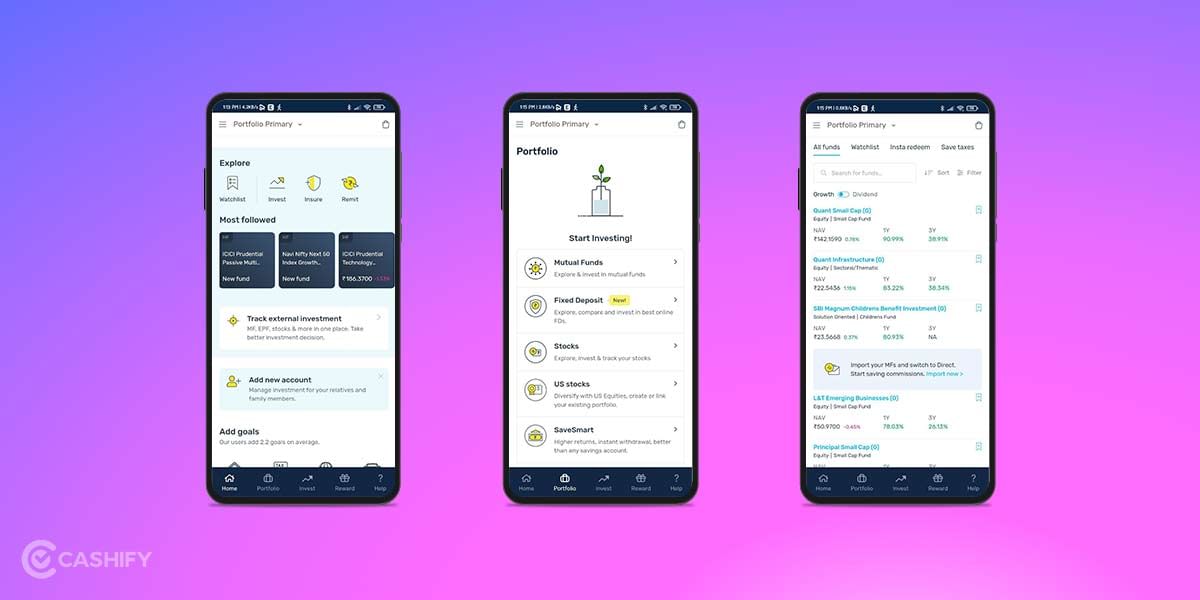

2. Groww

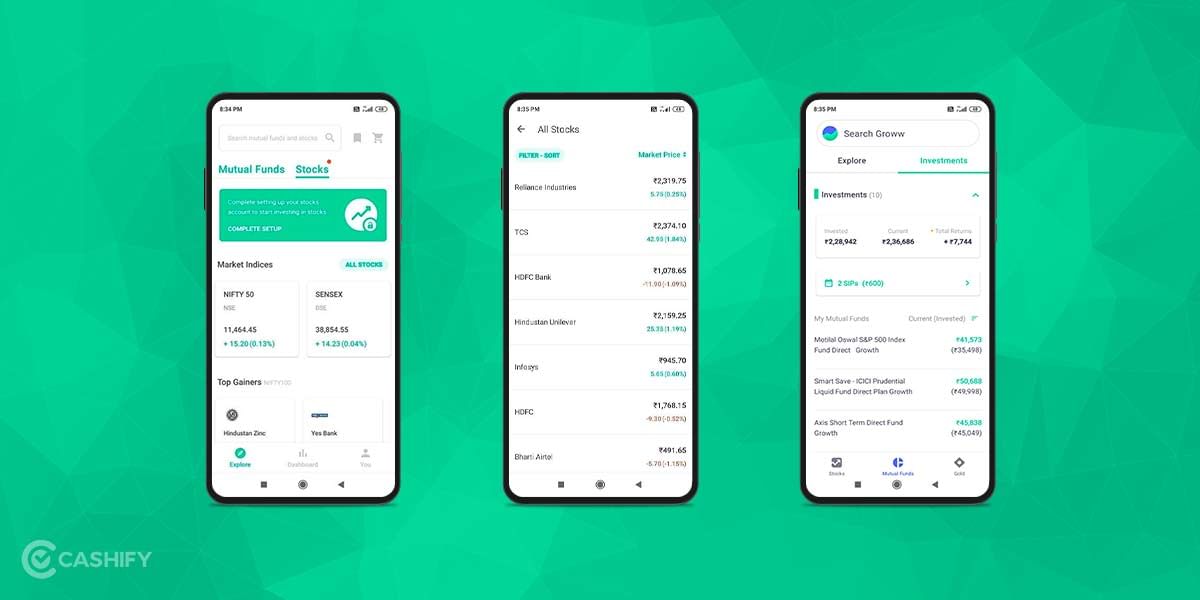

Groww is another app that you can use for investment purposes. However, I would suggest you use it if you’re new to the mutual fund’s investment scheme. This easy-to-use app has minimalistic features that let you decide and do your financial planning without any hassle. It has a single dashboard that lets you track all the investments, annual returns, etc. All you have to do to register on the app, get an account verification via KYC, and you’re ready.

Also Read: Laptop Is Plugged In But Not Charging, How To Fix This?

In terms of security, the application has 128-bit SSL encryption that keeps all your financial details secure. This easy-to-use app can be considered the best app to invest in mutual funds and start SIP.

3. Paytm Money Mutual Funds App

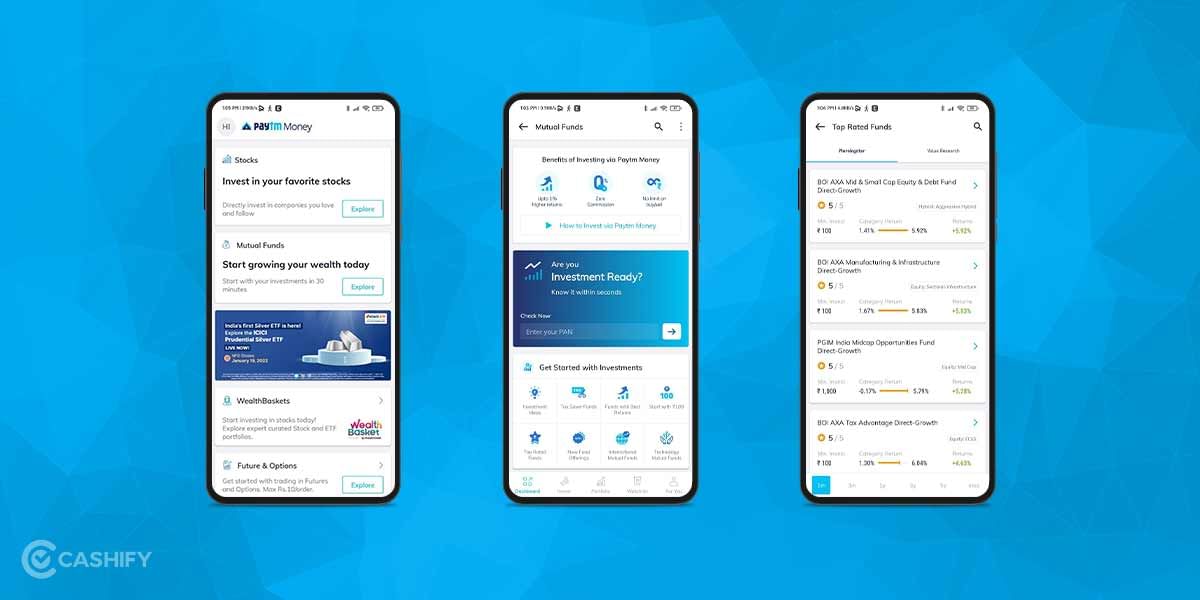

Paytm is a well-known app in the financial segment; we all use this app regularly. Though the primary use of Paytm is for making payments to a vendor, it also comes with additional financial services that you can easily opt for. Just install the Paytm money app and get going. On the Paytm money app, you’ll also get a 1 per cent higher return; you’ll also get various investment schemes and create your financial portfolio.

Also Read: Explained: What is Sim Swapping Attack? How To Stay Safe?

In addition, the app also doesn’t have any hidden charges if you’re buying or selling mutual funds frequently. It takes only 30 minutes to create an account on the Paytm Money app and start your financial investment plan. Paytm ensures you get quality service while signing up for your account, and the registration process is paperless. So, get on the Paytm money app and plan your financial planning well.

4. Kuvera

Kuvera is another awesome mutual fund investment application that you can use. It has a unique and simple user interface, and you can create an account on Kuvera in a few steps. You can create your financial portfolio, manage joint family accounts, and keep track of the investment. In addition, the app also has a simple yet informative dashboard where you can get all the information on policy, financial schemes and SIP. It also lets you set life goals and see if you’re on the right track. It also recommends trending mutual funds that can benefit you in achieving your goal.

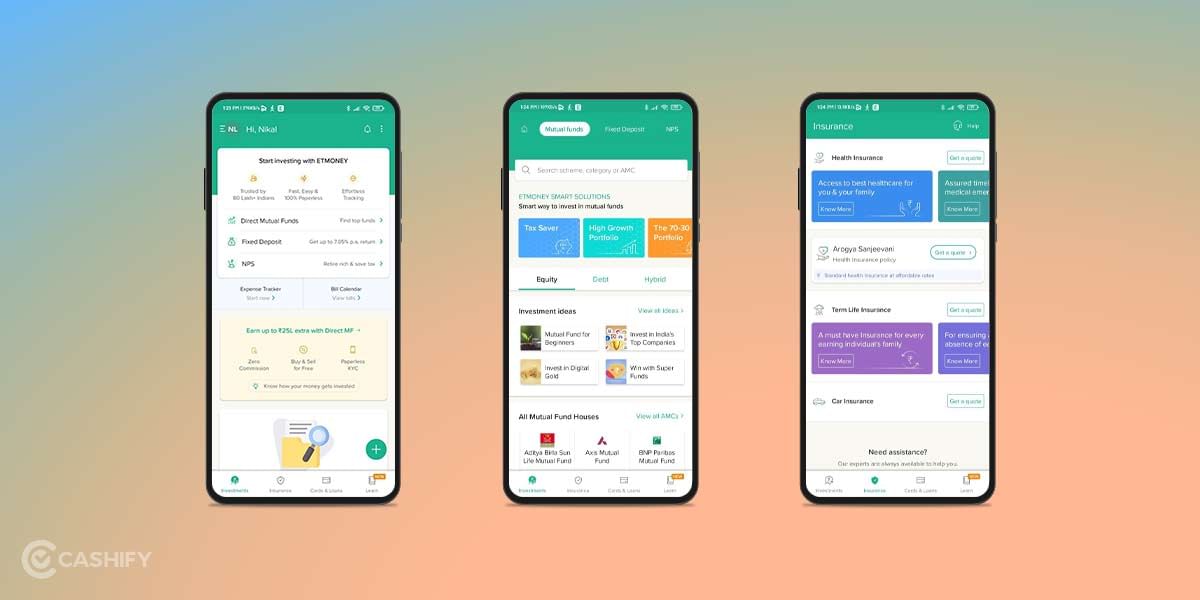

5. ET Money

ET Money is perhaps the best platform for investing. Developed by Times Internet and managed by the Economics Times publication, the ET Money app is an award-winning application with various benefits. You can easily set up your account and create your financial portfolio.

Also Read: Explained: What is OLED EX? The Next Generation Display Technology By LG

The most exciting part about the app is its financial calculator, where you have just set a goal, and the app will automatically suggest various mutual funds investment plans. It also has a very easy app integration method with various payment apps like GPay, PhonePe, Paytm, etc. The key feature of this app is the personalised section that will show you the best-performing mutual funds to invest in on the basis of the historical performance of the mutual fund scheme. It can be said that this is the best app for investing in mutual funds.

Also Read: How To Change WiFi Password? A Step-By-Step Guide

6. myCAMS Mutual Funds App

myCAMS is one of the most straightforward and lighter apps on this list. Due to its lightweight file size and minimalistic overall interface, everything is in front of you to use. So, instead of confusing you, myCAMS gets right to the point and makes investing in mutual funds easier for you.

Moreover, although it is not an extensively beautified app, it is feature-rich. There is the log-in via PIN and Pattern feature. Then, you can view your MF portfolio or open new folios. Additionally, you can easily set up your SIP, purchase, switch, and do whatever you find convenient seamlessly. Definitely, it had to enter our list of best apps to invest in mutual funds in India.

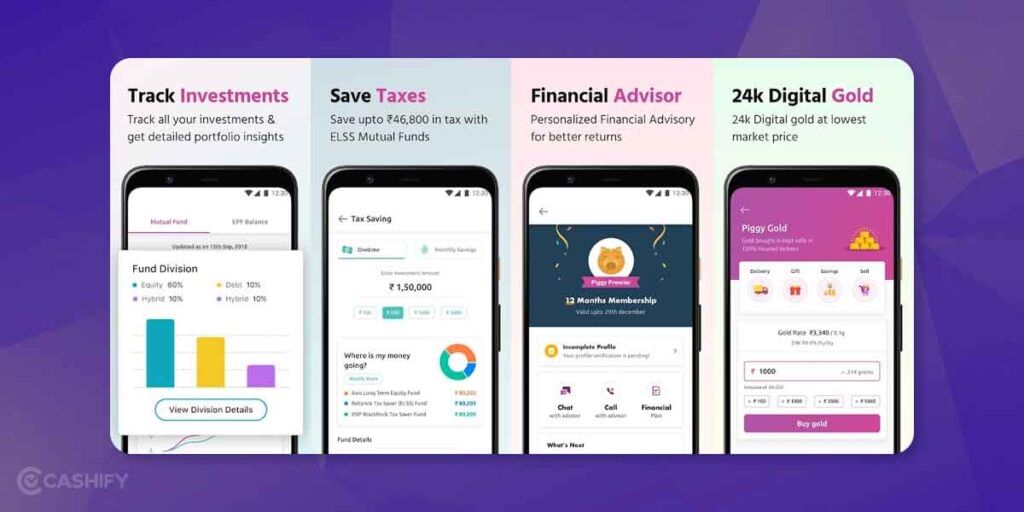

7. Piggy- Mutual Funds App

Introducing Piggy, India’s pioneering mutual fund app that revolutionizes how you invest. With Piggy, all your investment options are conveniently consolidated under one login, whether investing in Direct Mutual funds, Digital Gold, Managing Portfolio or tracking EPF.

Best of all, this app is completely free, with no hidden commissions or service fees. The sign-up process is incredibly easy, and by investing through Piggy, you can potentially earn up to 1.5% extra returns every year. Gain valuable insights into your mutual fund portfolio through detailed analysis and leverage goal-based investing. With Piggy, you can effortlessly assess the composition of your portfolio across various asset classes and sectors while also identifying the risks involved.

Also Read: How To Recharge FASTag Easily Online? Explained In Detail

8. Angel Bee App

Angel BEE is an all-in-one investment app that provides a one-stop solution for all your mutual fund investment needs. It helps you manage your mutual fund investments, SIPs, and other investment plans easily.

Unlike other apps that suggest where to invest, ANGEL BEE, with its unique feature, helps its customers achieve their goals faster by tracking all the investments made by customers on this app and actively notifying them whenever there is a need to exit and invest again.

Also read: Why Is My Mac Slow? 7 Possible Ways To Enhance The Mac Speed

We most certainly do hope that these applications help you as much as they have been of help to us. What are you waiting for? Enter the realm of mutual funds today and start saving your hard-earned money!

FAQs

Which application is best for mutual funds?

To invest in mutual funds, you can consider using apps like Coin by Zerodha and Groww.

Which is better, Groww or Zerodha?

If you’re an active trader looking for advanced features and lower brokerage charges, Zerodha might be a better choice. However, if you’re a beginner or focused on long-term investments like mutual funds, Groww could be more suitable.

Which platform is best for SIP?

If you’re planning to invest in SIPs, Paytm Money is a reliable platform to consider.

Does Zerodha charge for mutual funds?

No, Zerodha doesn’t charge any commissions or DP charges for direct mutual fund investments, making it a cost-effective option.

Which is better, Groww or ETMoney?

For beginners, both Groww and Zerodha are safe and user-friendly options. You can also explore other platforms like ET Money, Paytm, 5paisa, myCAMs, and Kuvera.

Is Groww safe for mutual funds?

Yes, Groww is a safe option for mutual fund investments. It’s registered with SEBI and AMFI, ensuring that your transactions are monitored and secure.

Is Zerodha 100% safe?

Yes, Zerodha is considered safe for buying stocks. It’s one of the largest stockbrokers in India and regulated by SEBI.

How much is 5000 for 5 years in SIP SBI?

Investing ₹5000 monthly in an SIP with SBI for 5 years could potentially grow to around ₹4,12,432.

Which SIP gives 40% return in India?

Several large-cap mutual funds in India have delivered over 40% returns in the past year. Examples include Quant Large Cap Fund, Bank of India Bluechip Fund, JM Large Cap Fund, and Nippon India Large Cap Fund.

If you want to sell your old phone or recycle your old phone, look nowhere else. Cashify is your way to go. Besides, you get rewarded for doing so, instantly!