You may have often heard the phrase ‘a company went public’ in newspapers or movies but don’t know what it means. The phrase implies that the previously private company is now issuing shares for people’s first time to buy.

When a private company approaches people to invest in them in exchange for shares is called an Initial Public Offering or IPO. Here in this guide, we will provide you with steps on how to use just your phone; you can buy stocks offered in an IPO.

Also Read: Top 5 Apps To Invest In Mutual Funds In India 2021

How to buy stocks in an IPO?

Earlier you could buy stocks in a newly launched IPO using bank ASBA (Application Supported by Blocked Amount) and broker ASBA.

How it works in ASBA is that you bid for IPO shares by filling up an application form. Once the shares are allotted to you, the amount is debited from your account.

While in broker ASBA it is an intermediary broker who does the bidding for you. A broker visits the form, fills up the application form to be part of the IPO, and does all the paperwork. Once this is done, the broker then takes your signature on the form, and then the form is sent to self-credited syndicate banks (SCSBs).

Also Read: Best Apps For Android And iOS To Help You Work From Home

This whole process was very tedious, and therefore common people often stayed away from investing in the IPOs of new companies.

But from January 1, 2019, the rules were changed, and the government allowed the retail investors to use the UPI system and invest in the stock. This opened up doors for many new companies such as Zerodha and Groww to reach ordinary people and give them an opportunity to invest in IPOs. With apps like these, it is very easy to invest in an IPO, and you don’t even have to go through any big pile of paperwork.

Also Read: Best Coupon Apps For Online Shopping In India

Things to keep in mind before investing

Understand your investor profile

Every investor is unique; therefore, you must ensure that you invest based on your investor profile. But how do you identify your profile? Here are few steps:

Financial goals

Define what you want your financial goal to be. What are you trying to achieve? Funding for a new home? Planning a marriage? Thinking of going on a world tour? With clearly defined goals, you will know how much and on which stocks you want to invest in.

Risk tolerance

The stock market fluctuates very frequently. If you are preparing to invest in stock for a big company like Reliance, Tata, etc. there will be no fluctuation in the price. But on the other hand, if you are investing in a new company and relatively small company that seems promising, then a great achievement of them will boost the stock price, while a failure can result in a crash. You need to determine how much volatility you can handle without panicking and going broke.

Also Read: Best Keyboard Apps For Android And iOS

Research about the company before buying

Unless you are a professional trader with lots of experience, don’t make investments based on the stock price alone. Investing in the stock market is a marathon, not a sprint so you have to be patient. Therefore you need to invest in a stock that can give you good returns in a long journey.

The best way to figure out which companies are right for investment is to assess the company’s financial condition. If the company is financially sound, it can then stand any economic turbulence, as we saw with the covid-19 pandemic.

Track investment carefully

Many times, investors invest in one of the companies and forget instead of keeping track of their investment. The stock market is a very volatile place, so by tracking your investment, you can have the opportunity to sell and balance your portfolio to have maximum gains.

Also Read: Best Torrent Apps For Android And iOS

How can you invest in IPO just using your smartphone?

After the government allowed purchasing stocks using UPI, there are many new platforms known as discount brokers like Kite by Zerodha and Groww. These platforms have mobile apps that you can use to gain insight into upcoming IPOs and which IPO you should invest in. So here is a guide on how you can use both the applications:

1. Investing using the Kite mobile app by Zerodha

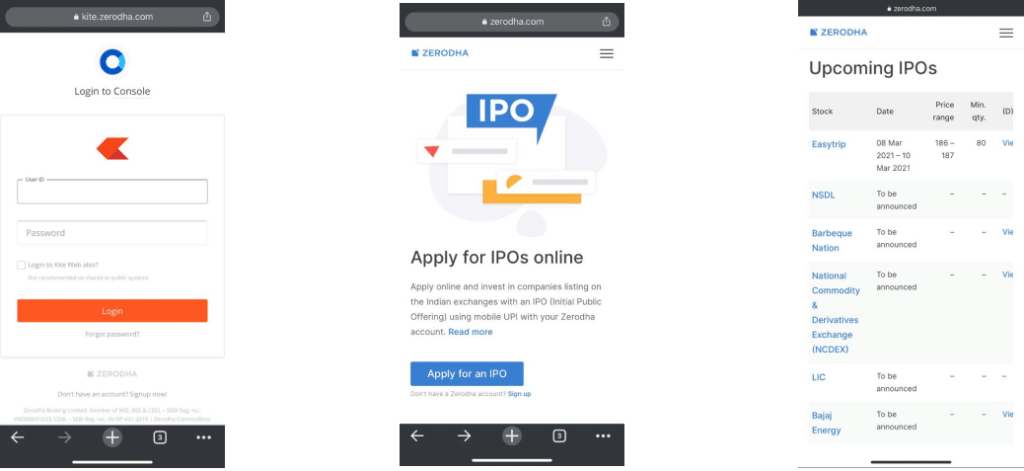

In order to use the Kite app, you need a Zerodha account; if you don’t already have one, you can make the account from the browser on your phone.

Download Kite App by Zerodha: Android | iOS

Zerodha has already mentioned the supported apps that can be used to buy IPO stocks through Zerodha.

- Once you login to the Zerodha platform, find the ‘Portfolio’ option

- In that, you now have to select ‘IPO.’

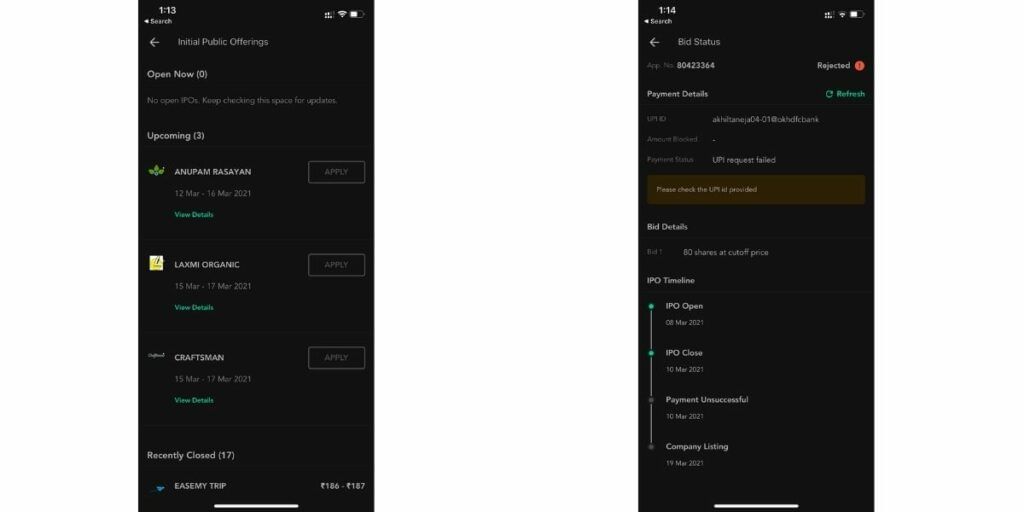

- From the list, select the listed IPO you want to apply to.

- Once you tap on the stock, you can now see all the stock details, like open date, close date, and lot size.

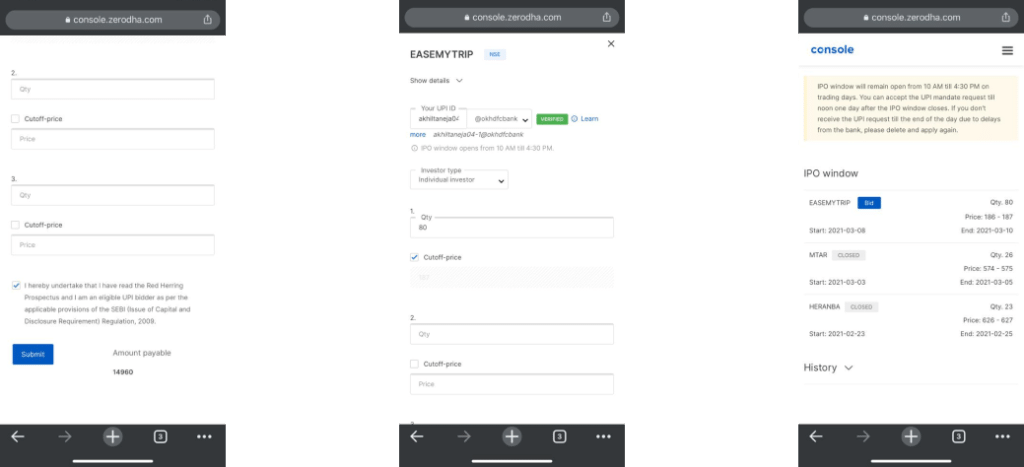

- Now you can enter your UPI ID that is assigned to your bank account. (Note: Be sure that the UPI ID you are entering is of the account that is linked with your private number. The application will get rejected if the person applying is different from the one whose bank account is.)

- You can now select the type of investor for your application. If you want to apply for the cut-off price, simply click on the ‘Cut Off-price’ checkbox. In case you want to enter different prices while bidding, simply click on the ‘Price’ field.

- Once you complete the steps, click on the checkbox and click on submit.

After you’ve completed all the steps mentioned, you’ll then receive a mandate request on your selected UPI app. As the system is new, it does take a few hours to receive the request. Once you receive the mandate, you are done. The amount of funds will be blocked in your account, and once the stocks have been allocated to you, the money will be debited from your account, and stocks will be credited to your demat account.

In case you don’t receive the allotment, the blocked funds will be released on the date of allotment.

Also Read: Best Desi Indian Alternatives To Chinese Apps

2. Investing in an IPO using Groww App?

Download Groww App: Android | iOS

- Download and log in to the Groww app.

- Go to the ‘Stocks’ tab and scroll to see the list of available IPO

- Click on the stock you want to purchase, and you’ll see details such as issue prize, price, etc.

- Now tap on ‘Apply,‘ and you’ll see the order card, which shows the minimum number of shares you can buy.

- Click on ‘Continue’ to go to the next step.

- Now enter your UPI ID and click on ‘Submit Bid.’

- A request will be sent to your UPI app. Once you are allotted stocks, that amount will be blocked in your account. It will get unlocked in case you don’t receive any stocks.

Also Read: Best Smart Air Purifiers For Home And Office In India

Final Point

There are a lot of things in stocks that you need to know before investing in one. While many companies may create a lot of buzz before launching their IPO, it is on you not to get scammed by their marketing tactics. Do thorough research on the company you are investing in from your end.

Disclaimer

Please pay attention that what we explained in this article is just advice and not a financial guide on investment in IPO. Do research from your end and if you think you should invest then only buy the stocks.

Also Read: Top 20 Value For Money Smartphones

For the latest smartphone news, stay tuned to Cashify. We also allow you to compare mobile phones so you can find out the better phone before buying.